Mutual fund have become popular these days among investment communities to invest or park their surplus money. There are various types of mutual funds like Equity Mutual Fund, Debt Mutual Funds, Exchange-traded Funds (ETF), etc.

The legal structure

This article will familiarize you with the legal structure and various constituents of mutual fund companies. Security and Exchange Board of India (SEBI) governs mutual funds through (Mutual fund) regulations, 1996, and as amended from time to time.

The first constituents in the formation of mutual funds are the SPONSORS, who are the initial persons behind mutual fund business formation. They put their investment and experience in forming an asset management business.

Sponsors form TRUST through a trust deed, which is operated by trustees or a Trustee company.

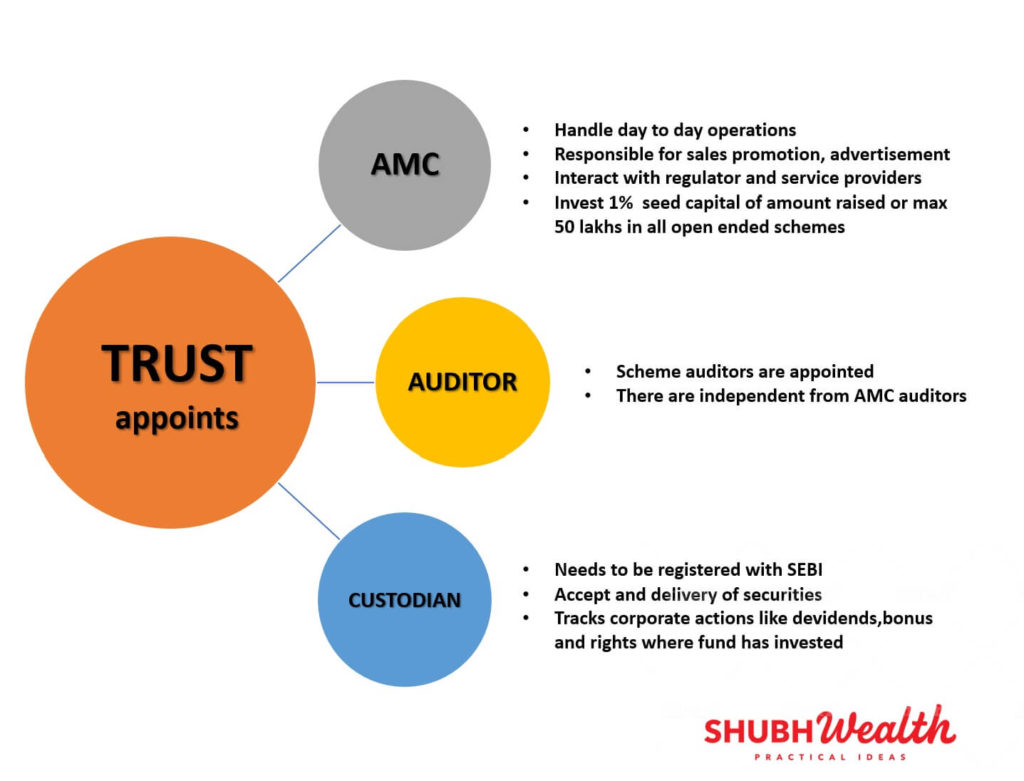

Trust appoints various constituents to perform day-today operations for mutual funds business.

Trust constituents

Asset Management Company Limited (AMC), CUSTODIAN and AUDITORS are various constituents appointed by the trustees.

The AMC is the entity that is responsible for running day to day business activities of a mutual fund company. Trustees appoint individuals to run day-to-day operations of AMC. These appointed individuals should have adequate experience in the financial services business and a clean background.

AMC officers personally also ensure that investment of funds of any schemes is in accordance with SEBI regulation and trust deed.

Conclusion

This is the broad structure of the asset management companies. Segregation of roles for different entities ensures that investor money is safe and can not be mishandled. For example, the money from the investor is collected by RTA, the investment decision is taken by AMC personnel’s and the assets are handled by Custodians.

Investors can rest assured that their investment can not be diverted to wrong entities. they can invest in mutual fund schemes either through a one-time investment or through a Systematic investment plan.

Pingback: Magical Tips for financial investment...Right way • ShubhWealth

Pingback: 3 best ways to increase your SIP returns • ShubhWealth

Pingback: What are Largecap,Midcap & Small Cap stocks and Mutual funds • ShubhWealth

Pingback: All About Debt Mutual Funds • ShubhWealth

Pingback: How to reduce capital gain tax through Indexation? • ShubhWealth

Pingback: Sensex and NIFTY | Meaning and differences • ShubhWealth

Pingback: PAYTM Money (Mutual fund) | Honest review