Mutual funds have grown more than 20% compounding for the last 5-10 years. This article will discuss various aspects of debt/bond and its derivative DEBT MUTUAL FUNDs. Debt mutual funds have gain popularity as they offer taxation(Indexation Benefit), diversification and liquidity benefits.

What is Debt?

Bonds are the instruments or securities issued by various entities to raise money for a definite time period and issued at a predetermined interest rate called the coupon.

Debts are loans taken by various entities at a specific rate. The Loans are to be repaid over a fixed period along with interest. Borrowings have to be repaid in a periodic manner say monthly, quarterly, yearly, etc. Example; Home loan, Personal loan, Working capital loan, etc.

Debt Mutual Fund

Securities or instruments issued by Corporate or Government institutions constitute debt mutual funds.

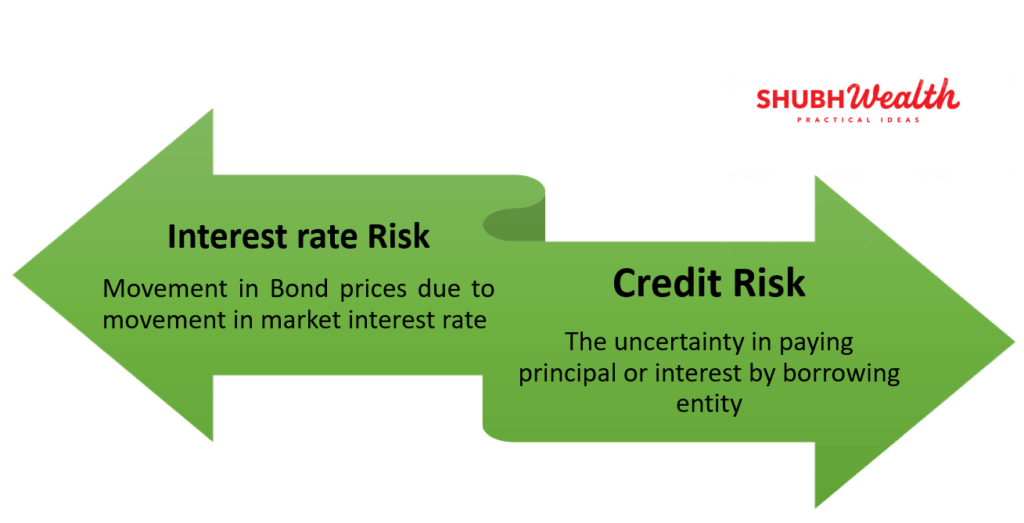

The price movement of bonds depends on two factors associated with debt securities. They are followings:-

- Credit Risk – Risk of business or Corporate closer

2. Interest Rate Risk – the movement of interest rate in the market

How Debt Mutual Fund Generate Returns?

The factors which impact the valuation of a bond are the following.

- Face value ( price at which Bond is issued for the first time)

- Coupon (rate of interest which Bond offers)

- Market price (the rate at which Bond is traded)

- Bond duration and prevailing market interest rate(G-sec 10 YEARS bond rate).

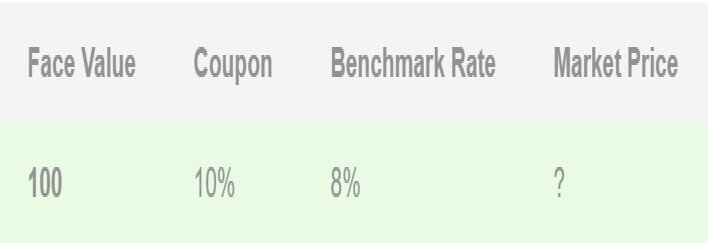

Suppose a Bond /Debt security is issued at Rs.100 (Face Value) offering a 10% interest rate per annum.

The first-time buyer will buy at Rs.100 from the primary market. (First-time issuance).

Depending upon interest rate in the market/benchmark (Benchmark is 10 YEARS G-SEC rate), the buyer or seller decides whether to buy or sell and at what price.

Let us understand with example …

As the bondholder is getting higher interest on his bond (10%) relative to the market(8%), he will ask for a higher price for the bond i.e. more than Rs 100. Similarly, if the G-Sec rate is higher than the bond coupon rate it will sell at discount.

Current Yield

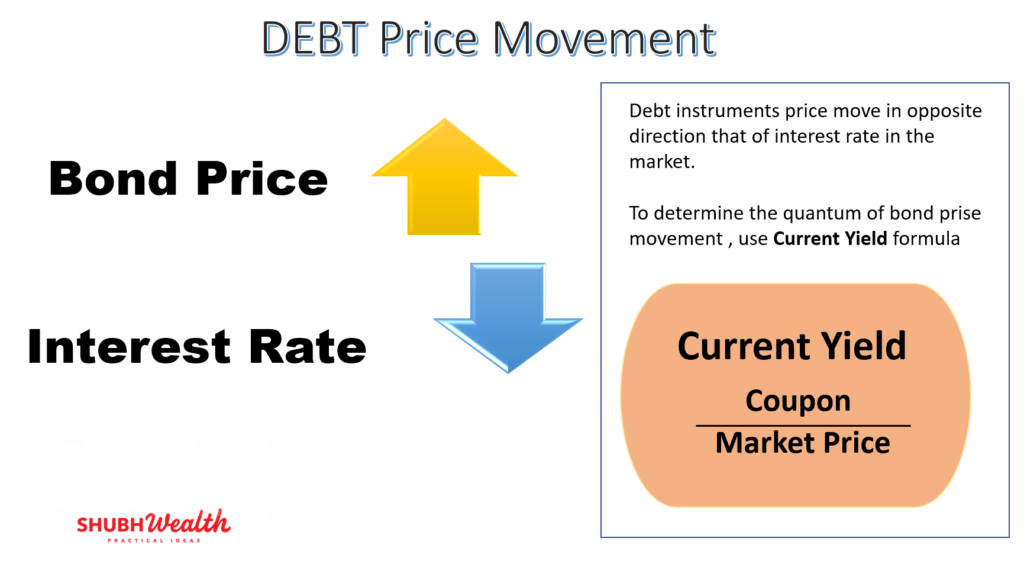

The simple way to calculate the market price of a bond is by the used formula of Current Yield.

Current Yield = Coupon/Market Price

In the above example;

8% = 10% / Market Price

Market Price = 10% / 8% = Rs.125

In another example;

Bond Coupon is 8% and Market Rate is 10%.

The Bond price would be 8 / 10 = Rs.80.

The above-mentioned example shows that the movement of interest rates in the broader market has an impact on the prices of the bond. This movement of bond prices due to movement in the interest rate in the market is called INTEREST RATE RISK.

Besides the interest rate movement, there is appreciation in the price of bonds due to the increase in business fundamentals of the issuer. Let us understand with an example

All bonds issued in the market have to be rated by rating agencies like CARE, ICRA, etc. Suppose while issuing first time rating of a bond is “AA” and with improvement in business fundamentals and balance sheet the rating improves to “AAA”.

Re-rating of a bond implies less risk and it will add a premium to current bond price. Thus, it leads to a price increase in bond. This risk is termed as CREDIT RISK.

Considering these two factors, a mutual fund manager constructs a portfolio based upon the investment mandate of a particular fund.

Conclusion

There are various Debt Fund Types depending upon various parameters like portfolio maturity duration (interest-rate risk) and quality of paper in the portfolio (Credit risk). Higher the risk, returns are better. Longer the maturity duration or Lower the quality of the portfolio, the higher will be expected return.

How debt fund offer taxation benefits?

The taxation benefit for debt funds are by way of Indexation benefit which increase your purchase cost by the inflation rate for holding period. Be in touch , we are going to come with post regarding that also. thanks

Pingback: How to earn Higher Tax-efficient return than Fixed Deposit or Debt Mutual fund? - ShubhWealth

Pingback: Voluntary Provident Fund (VPF): Best Debt investment (Salaried class) • ShubhWealth

Pingback: 4 Best Child Investment Plans (Mutual Funds) • ShubhWealth

Pingback: Mutual Fund details everyone Should know before investing • ShubhWealth

Pingback: What are Largecap,Midcap & Small Cap stocks and Mutual funds • ShubhWealth

Pingback: How to reduce capital gain tax through Indexation? • ShubhWealth

Pingback: Pradhan Mantri Mudra Yojana (PMMY)| Guide to apply • ShubhWealth

https://waterfallmagazine.com

This is very fascinating, You’re an excessively professional blogger.

I have joined your feed and look ahead to in quest of more of

your wonderful post. Also, I’ve shared your web site in my social networks