Parents always have the future of their KIDs as their top priority. To give the best facilities available, you need plans to accumulate large some of the money. Today we have various Child investment plans available in the market to meet the financial requirements of our kids.

There are various Child investment plans offered by various financial institutions like banks, insurance companies, government agencies, and mutual funds. This article will give you the pros and cons of different investment plans and avenues available in the market.

This blog post will sensitize you about pressing issues of Childs growing expenses and try to give you practical solutions as to how you can address these challenges.

Through this post. You will see

- Why is it essential to plan for Children’s future expenses?

- How can we meet the expenses?

- What are the investment schemes best suited to achieve these goals?

Why is it essential to plan for Children’s future expenses?

There are multiple reasons why today, it is crucial to plan for our future child expense.

- We have the largest and youngest population in the world

- India has more than 50% of its population below the age of 25 and more than 65% below the age of 35.

- This massive influx of young people will increase the demand for education and vocational subjects at astronomical levels which in turn will increase the cost for professional courses in particular and overall education in general. To give you a perspective, from 2008 to 2018 the number of students giving the exam for IIT entrance has increased from 1.78 lakhs to 12 lakhs, for Medical the number has gone up to 12 lakhs from 2.3 lakhs and for MBA CAT exam it has gone from 0.96 lakhs to 2.31 lakhs.

- Such high demand will make the cost of education grow at a fast rate. For example, in the last ten years, School and tuition fees have increased by 150%, Private school fees have risen by 175% and Technical school education has been increased by 96%

- These numbers are from the last ten years when the competition was not much, going forward the expense will be many folds as students’ number will keep on rising

- Today it is a necessity to give our children the best education we can offer so that they can compete well in society.

- One has to translate these numbers in percentage. The growth is more than 10 -12% in general for the education itself.

How can we meet the expenses?

The average increase in educational expenses has been anywhere in the range of 10-12% per year for the last ten years. In the case of elite schools or colleges or foreign education, the expense growth rates are much higher.

Since the expense is growing annually at the rate of 10-12% per year, we need to look for avenues where long term post-tax and post expense average return is more than average inflation of 10-12%.

Let’s analyze Child investment plan available

Life insurance plans

These are the most famous child investment plan available in the market. The popularity is not based upon product benefits but the commission which intermediaries get. That is why most of the intermediaries like Banks or agents, will first recommend Child insurance plans.

I will not recommend these plans for child investment plans for the following reasons

- You should not mix life cover with investment as the expense for this type of scheme are much higher. The higher upfront expenses will result in lower maturity value.

For Example:

You have invested Rs 100 in a scheme. Expenses are Rs 10.

Investment amount: 100-10 =90

Investment return is 15% ; Therefore Maturity Value : 90 + 90*15% = 90+ 13.5 = 103.50

Where as

In Investment where expenses are not Upfront there your investment at 5% return will give you 105/- at maturity.

The point I would like to highlight in the upfronting of expenses (deduction of expenses before investment) will require a much higher rate of return in comparison to an investment vehicle where expenses are not deducted upfront.

In the above example, the upfront deduction of expenses with even a 15% return will not be able to match maturity value (103.50) of a scheme where the upfronting of fees is not there with a 5% return (105).

- The purpose of the Insurance Child investment plan is first to provide insurance in case of eventuality and then return and not another way around.

- An investor will be better taking separate insurance cover and investment products to meet the desired goals. The cover will be much higher at a lower cost and returns will be higher in investment products due to lower cost.

- Due to the higher upfronting of the cost, the actual desired return of 12-15% would be challenging to reach.

Fixed income products

The fixed return products like Banks FDs or Government Schemes like Sukanya Samriddhi Yojana as their own drawbacks and benefits.

- The positive aspects of these schemes are their assured returns.

- Taxation is the biggest drawback of these investments. They are taxed on accrual basis meaning you need to pay taxes every year on interest accumulated irrespective of your withdrawal of investment and at your applicable tax rate.

- Return on these products is less compared to equity-oriented products. The interest is generally in the range of 2-3% above inflation

- These debt investments are not eligible for Indexation benefits which debt mutual funds are eligible.

Sukanya Samriddhi Yojana

- The natural or legal guardian can open the account for a girl child of age below ten years.

- A depositor can open and operate only one account in the name of a girl child under the scheme rules.

- The natural or legal guardian of a girl child is allowed to open the account for two girl children only.

- The attractive interest rate of 8.4% (FY 2019-20) that is fully exempt from tax under section 80C.

- Minimum Rs. 1,000 can be invested in one financial year

- Maximum investment of Rs. 1,50,000 can be made in one fiscal year

- If the minimum amount of Rs 1000/- is not deposited in any fiscal year, a penalty of Rs 50/- will be charged

- Deposits in an account can be made till completion of 14 years, from the date of opening of the account

- The account shall mature on end of 21 years from the date of opening of the account, provided that where the marriage of the account holder takes place before the end of such period of 21 years, the operation of the account shall not be permitted beyond the date of her marriage

- Passbook will be issued to customers.

- Withdrawal Facility

- To meet the financial requirements of the account holder for the purpose of higher education and marriage, the account holder can avail partial withdrawal facility after attaining 18 years of age.

- If the beneficiary is married before the maturity of the account, the account has to be closed.

- The scheme is excellent for accumulation purposes but may not be suitable for meeting future goals as the return will always be lower than the targeted return of 12-15%.

Mutual Funds

I would personally recommend Child Investment plans from mutual funds companies based on the following reasons

- The historical returns show they give the best performance compared to any investment vehicles available. Equity as an asset class has given performances in the range of 12-15% return on a long term basis of 10-15 years

- Cost of these products are low, which give more probability of higher returns without upfronting of expenses

- The taxation on these products is very low. The long-term capital gains are taxed at 10% above 1 lakh of capital gains as of FY 2019-20 taxation.

- Diversified investment, as child investment scheme, invest in 40-50 stocks

What are the investment Mutual Fund schemes best suited to achieve goals?

As I have discussed, Mutual funds Child investment plans make the most sense as they provide the best benefits in terms of returns, low cost and taxation benefits.

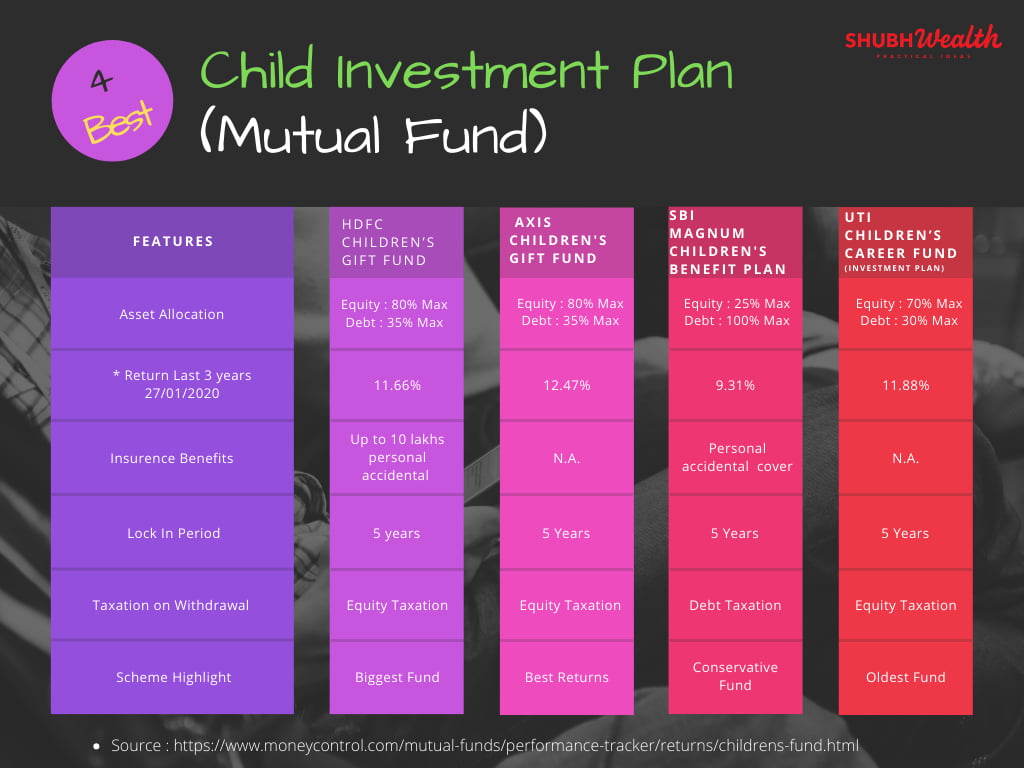

Below mentioned are the four schemes which provide best benefits according to my analysis

- HDFC Children’s Gift Fund

- Equity oriented fund having equity exposer up to 80% of the portfolio

- Personal accident insurance for parent/guardian of up to Rs 10 lakhs

- Well managed diversified portfolio

- For more details do click

- Axis Children’s Gift Fund

- An equity-based fund having equity exposer up to 80% of funds

- Performance of the fund has been exceptional in the last three years

- Click for more details

- SBI Magnum Children’s Benefit Plan

- Conservative fund having maximum Equity exposer up to 25% of the portfolio

- Personal accident insurance cover against accidental death or permanent total disability relating to these accidents

- Accidental death receives an additional 10% of the claim amount towards educational expenses

- Click for more details

- UTI Children’s Career Fund (UTI CCF)

- Two variants – UTI CCF-Savings Plan (Conservative -Equity Max 40%) and UTI CCF-Investment Plan (Aggressive -Equity Max 70%)

- Tax relief under the scholarship option – paid to meet educational expenses does not form part of the total income of a beneficiary under section 10(16) of the Income Tax Act, 1961

- Cash Investment allowed up till Rs 50,000/- under the scheme in a financial scheme

- Click for more details

Conclusion

In your quest to provide the best facilities to our child, you always look for the best option available, be it education, sports, profession, etc.

There is no denying the fact that to provide the best facility; we need to pay a higher price. In the last decade, we have seen that the cost of education, marriage etc has grown on average 10% or more. To meet these expenses, we need to plan well in advance. IIM education which was costing 23 lakhs in 2019, will cost 60 lakhs in 10 years at 10% cost escalation.

There are various Child Investment plans are available to plan for it. These all investment vehicles will have their own pros and cons. The essential criteria to filter these investment vehicles is to look at their post-tax and post expenses return, along with safety and regulation.

I would recommend that the best vehicle to meet these goals are mutual fund schemes. I have discussed four best schemes which are available in the market. Plan well for your children’s future.

Neatly explained!.

Pingback: What are Largecap,Midcap & Small Cap stocks and Mutual funds • ShubhWealth

New perspective for planning for out kids future.

Explained in the common man language.

Good work .

Awesome post! Keep up the great work! 🙂

Pingback: Top 100 Investment Blogs in India - LivYoung Realty