Post office schemes are the most popular saving and investment avenues among INDIAN investors.

The success Post office schemes are due to multiple factors like post office reach, more than 1,54,965 branches all over INDIA, and government-sponsored schemes.

Some of the most popular schemes are Recurring Deposits (RD), Senior Citizen Saving Schemes (SCSS), and Public Provident Funds (PPF) and many more.

Here I am going to bring to you the best tax saving scheme which is available through Post office savings schemes.

These schemes provide assured returns (backed by the government) and tax benefits/exemptions at various stages of investment.

Post office schemes like PPF and Sukanya Samriddhi Yojana provides tax exemptions in all three stages of investment. ie during investment,accumulation as well as on maturity.

These schemes fall under EEE category – EXEMPT,EXEMPT,EXEMPT

How to calculate the INVESTMENT amount for INCOME TAX BENEFIT?

There are various sections of INCOME TAX, through which taxpayer can reduce their tax outgo by investing suitably.

Here we will discuss specifically SECTION 80C. Under this section, the taxpayer can reduce taxable income up to Rs 1,50,000/-.

The various investment and deduction allowed

- Investment in Public Provident Fund (PPF)

- Employee’s share of Provident Fund (PF) payment

- National Saving Certificate (NSC)

- Life Insurance Premium payment

- Children’s School and tuition payments

- Home Loan Principal repayment

- Sukanya Samriddhi Yojana investment

- Insurance Unit Linked Insurance Plan (ULIP) investment

- Mutual fund -Equity Linked Tax Saving Schemes (ELSS)

- Notified annuity Plan from insurance companies

- Pension funds notified by Mutual funds

- Five Years Fixed Deposits

- Notified NABARD schemes

- Post office Senior Citizen Saving Schemes (SCSS)

- Kishan Vikas Patra (KVP)

The above mentioned is not an exhaustive list but famous and popular avenues.

Investors first need to determine which avenues they already have investments or deduction.

Salaried employees will have their Employee Provident Funds (EPF) investment by default.

Father and Mother will have their children’s tuition fees as a deduction.

Those who already have a life insurance policy can claim premium payment as a deduction.

The home loan can provide the bulk of their 80C investment as principle repayment comes under this section.

Above all mentioned investment/deduction will form part under section 80C, and the total of all put-together is eligible under section 80C subject to a maximum of Rs 1,50,000/-.

Therefore, you need to add up all existing investments or deduction if the sum is less than Rs 1.5 lakhs than one can explore other saving/investment avenues listed above and invest.

Selecting an investment vehicle should depend upon one’s risk appetite, liquidity position, and future goal.

My advice would be to select the right scheme rather than the best plans. Do read more

There is a preconceived notion that POST office schemes are not right from the perspective of return or TAX efficiency. This section will explore various Post office saving schemes, which, besides interest, can also give Tax benefits.

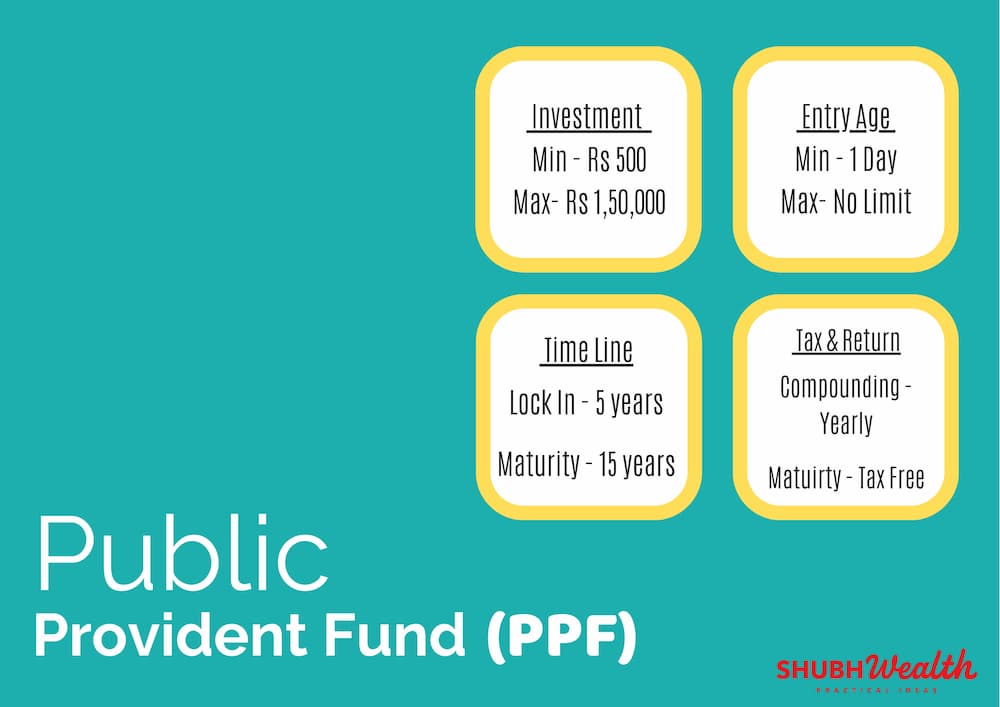

Public Provident Fund (PPF)

The scheme made for informal/non-salaried class individuals for their retirement planning.

The scheme opens for all adult population and can continue until their retirement.

PPF Scheme gives you Exempt, Exempt, Exempt (EEE) benefits in all three stages of investing. Ie, Investment, accumulation, and maturity.

The other Highlights are as follows

- In 1968, The National Savings Institute bought a Public Provident Fund(PPF) scheme.

- PPF account is open for all INDIAN citizens, No HUFs

- In a Financial year subscriber can deposit from Rs 500/- (minimum) to 1,50,000/- (maximum)

- Under Sec -10(15 of Income Tax Act interest earned in PPF account ar tax exempt.

- Loan Facility is available from 3rd till 6th FY

- PPF account matures in 15 years after investment and investor can extend further in 5 years blocks with or without further investment

- There is no entry age for the opening of account

- PPF account, an investor can open at selected Post offices and banks

- Account opening charges are Rs 100.

- In a financial year, one can deposit 12 times and a maximum twice in a month.

- The amount deposited from 1st -5th of any months are considered for interest calculation of current month

- For online account opening, Aadhar has to seed in the bank account, and mobile number has to be same in the bank account and Aadhaar

Voluntary Provident fund is another good alternative available for salaried investors. Do read

Senior Citizen Saving Scheme (SCSS) -Exclusive Post office schemes

There are very few schemes that are targeted for SENIOR citizens (above 60 years) for tax savings.

Those senior citizens (above 60 years) looking for regular income and risk free return should invest in this scheme.

SCSS fits the bill to perfection. The scheme will give you quarterly pay-out (taxable) and tax savings benefits.

The other highlights of the scheme are

- Senior citizens above 60 years of age can open the account

- Retired on superannuation or under VRS can open account between 55-60 years also

- Maturity period is five years

- One can open a Joint account but with spouse (Husband/wife) only.

- In the case of SCSS accounts, quarterly interest shall be payable on 1st working day of April, July, October, and January.

- An investor can withdraw before maturity

- If closed before one year, no interest will be payable, if paid already will be recovered.

- Closing after one-year an amount equal to1.5% of the deposit to be deducted

- One percent of the withdrawal amount charged for withdrawal after 2 years

- An investor can extend the account for three years

- Incase interest in a year exceeds more than Rs 50,000/-, post office deduct tax (TDS).

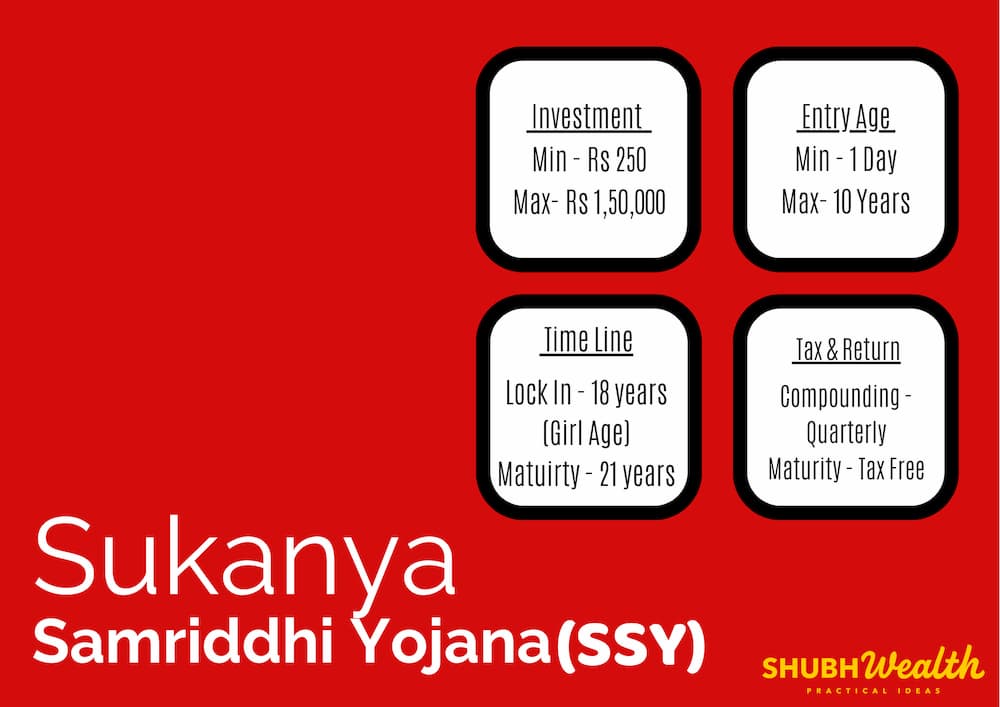

Sukanya Samriddhi Yojana (SSY)

One can invest in their girl child name and also avail tax benefit under section 80C.

The scheme provides better interest than most of the prevailing BANK Fixed deposit rates.

The scheme is also an EEE benefit scheme, which makes it one of the best plans for securing a girl’s Child future.

Other highlights of the scheme are as follows

- The natural or legal guardian can open the account for a girl child of age below ten years.

- A depositor can open and operate only one account in the name of a girl child under the scheme rules.

- The natural or legal guardian of a girl child is allowed to open the account for two girl children only.

- Deposits in an account can be made till completion of 14 years, from the date of opening of the account

- The scheme shall mature on the end of 21 years from the date of commencement of the account, provided that where the marriage of the account holder takes place before the end of such period of 21 years, the operation of the account shall not be permitted beyond the date of her marriage

- Withdrawal Facility

- To meet the financial requirements of the account holder for higher education and marriage, the account holder can avail partial withdrawal facility after attaining 18 years of age.

- If the beneficiary is married before the maturity of the account, the account will be closed.

- The scheme is excellent for accumulation purposes as it has EEE benefits, and post-tax return will be considerable.

National Saving Certificate (NSC)

These are five years deposit scheme which will provide tax benefit.

- Investment can be done single or jointly or by minor above ten years.

- The investment is transferable from person to person.

- AADHAAR is mandatory to open the account

- The annual interest accrued in the account is reinvested in the account and considered as section 80C investment. This help investor for tax exemption without investing the amount.

Post office FD deposits (5 years) – Exclusive Post office schemes

Fixed deposits made for 5 years are eligible for tax exemption under SEC 80C from post office.

Highlights of the scheme are

- Compounding of interest happens annually, and interest paid yearly.

- Premature encashment not allowed before the expiry of 6 months, If closed between 6 months to 12 months from date of Opening, Post Office Saving Accounts interest rate will be payable

- Investment can be done single or jointly or by minor above ten years

- The investment is transferable from person to person.

- AADHAAR is mandatory to open the account

Bottom line

In Financial investment asset allocation is very important.

In case you are short in your debt investment and looking for avenues that have additional benefits of TAX Savings, then Post office schemes are good options.

The information provided above can help you make informed decisions as to which plan to choose.

The interest rate offered to the investor in post office schemes changes from time to time by government notifications.

National Saving Institute website where one can view the latest interest rate of various Post office schemes.

Do write your comments and feedback.

A must read for all salaried employee. Great piece of practice information.

Pingback: Become Mutual Fund Advisor (Know Why?) | Enroll NOW !!!

Hey, great content! I must say the way you have jotted down the points is just amazing. Thanks for sharing this, it was really helpful for me, and hope would be for all of us as well. But during this lockdown period have you ever thought that you are left unaware or have been un-updated with the latest new decisions taken by the government every single day on the 3 important sectors of the economy (Banking, Finance & Insurance)? If your answer is YES, then I have some really great news for you. The economic scenario of our country is changing rapidly keeping in pace with the world economic scenario. Indian economy is standing on the crossroads where a little change in the Govt. policy and/or market response, labor indiscipline counts much.

In this situation, it is very important to keep yourself apprised of the prevailing trends of the economy. Our journal Banking Finance brings you the latest information of the Indian Banking through its pages containing several innovative research articles and features that are not available elsewhere. It keeps you updated with the development of the Banking and Finance Industry every month. The journal has entered into uninterrupted 33 years of publication in the year 2020.

So, what are you waiting for SUBSCRIBE US today!!

Pretty! This was a really wonderful article. Many thanks for providing this information. Cynde Basilius Godber

Astonishingly user pleasant website. Tremendous info offered on couple of clicks. Charmane Kendall Lolly