The crorepati formula will help us to be rich or to say have enough money to have a financially self-sustainable and wealthy life.

The phrase money itself is a misnomer to many things ie when we talk about money, we include most of the assets we have, it may be movable and non-movable assets. Like a property, gold, cash, BANK FDs, Mutual Funds, shares, debentures, etc.

The important aspect to keep in mind is most of our assets are not liquid enough. by the liquid, we mean conversion into cash on short notice, say 2-3 days. Financial assets like bank Fixed deposits or Mutual funds can be liquidated in a short period of time.

We can’t liquidate most of the physical or non-movable assets in a short period of time.

Crorepati Formula

We all want to have that magical eight-figure money in our account one day. The question is how to accumulate this figure, without compromising on our day to day lifestyle. Here is how.

Rule of 15

The mantra is to invest Rs 15,000/- every month for 15 years in an investment portfolio which gives a 15% return. It can be in mutual funds or Stocks through Systematic investment plans.

15000 Per Month * 15 years * 15% return = 1,00,00,000

We can easily cross-verify this calculation using excel using Future value formula.

Money Doubling Rule….

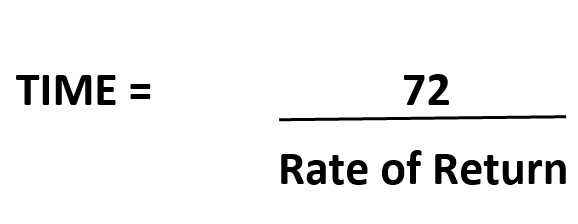

This rule gives us around about the idea of how much time investment will take to double your money provided rate at which investment is growing.

For example: if an investment is giving a 12% compounding return than the money will get double in 6 years. Ie 72/12 = 6

Otherway to look into it is, if we want 1,00,000/- after 6 years, so today we need to deposit 50,000/- in investment which may give 12% compounding returns.

We can use the formula for determining either Time / Rate of return for doubling our investment.

These formulas are not sacrosanct, they will give you a rough idea of maturity value over a period of time. Shubhwealth.

The formulas are put in laymen’s terms that made me so easy to understand the concepts

Yes,tejas…our aim is to write in a language to be understood by new /novice invesotrs

It a wonderful effort put together to help novices like me. Please keep posting. 👍

It’s very helpful, keep posting

Sure..the aim is to bring fresh perspective to new investors

Great work bsb

thanks Shankti…

Rule of 15, great idea. I will try to invest the same. Let’s become crorepati.

Thanks for writing ..

Easy language. Useful information. Keep posting.

Very important information put in very simple words. Keep it going with more such valuable and useful information.

Thanks Alok..be in touch

Great idea ,finally a blog to understand the novices like me😀 it’s very helpfull & will try to apply.keep rocking!!

Great, then let’s play kaun banega crorepati 👍👍

Thanks Arup..be in touch

Excellent article. Extremely helpful for new age investers. It really helps in setting the goal and then invest rather than haphazard investing.

Planning to shuffle my portfolio. Thanks Shubh Wealth!

Dear Adarsh…thanks for writing, please be in touch.

Very informative. But how to get 15pc returns?

Thanks for appreciation, If you see average equity return of Indian market,since last 40 years the Sensex has given 17%+ return. In the last 10 years market has returned 16% plus return. These are index level return,active funds has returned better. plan accordingly. Please remember your 90% return is due to asset allocation. plan accordingly.

Cool. Thanks for sharing this 15 ka formula. Now I can see what my corpus of saving may turn out to after certain period.

Informative.Great ideas.

Thanks..be in touch

Great article ..any example of such portfolio?

superb

Pingback: Best Post office (Tax Saving) schemes under Sec 80C

Great and an article!

King regards,

Boswell Duke

Like!! Great article post.Really thank you! Really Cool.