Mutual Fund performance tracking is as important as selecting the right mutual fund for your investment objective.

I will show you how and where you can get details of your mutual fund transactions.

How you can track performance for free and, most importantly, compare with other funds for better decision making.

In INDIA, Mutual Fund products have two plans. One Regular Plan, which is distributed by distributors who are compensated by Mutual fund companies. The distributor fee is deducted from your investment. This expense lowers investor return.

Second is called DIRECT PLAN, where mutual fund companies charge only fund management fees. These plans are cheaper for an investor as there are no distributor expenses involved.

To track mutual fund performance, you can rely on your distributor to provide a performance report periodically.

There are distributors for REGULAR as well as DIRECT plans in INDIA.

Banks, National Distributors like NJ, HDFC Securities, ICICI Securities, Independent Financial Advisors (IFAs) distribute REGULAR PLANS. They provide software to their client to monitor portfolio performance.

DIRECT plans are distributed by SEBI impaneled Registered Investment Advisers (RIA) like most of the fintech companies like PAYTM Money, ET MONEY, KUVERA, and mutual fund companies themselves or through their RTA website/app or their offices.

Both the cases Investors have to depend upon distributor to know about the performance of their mutual fund scheme.

Problem with Mutual Fund performance tracking?

What if you are no longer dealing with the distributor through whom you have bought the investment?

Or

you are not happy with the service or software of the distributor and want to track on your own?

Or you bought through mutual fund companies directly?

The other major issue with the apps of most of the distributors is there is no comparison with the peer group. In case you want to compare with best performing mutual fund or Top performing mutual fund, these comparisons are not available.

I am going to tell you the best, easy and free way to deal with all the issues which you might have faced or don’t want to meet in the future.

Consolidated Account Statement (CAS) – All mutual funds transaction history

To monitor your mutual fund investment performance, the first thing you need is your mutual fund investment details. Transaction history Like when you have invested? How much have you invested? Which scheme you have invested, how much dividend you have received? Etc.

To get all these details, the Registrar and Transfer Agents (RTA) like KARVY, CAMS, and Franklin Templeton have started a universal service called Consolidated account statement (CAS).

In CAS statement you will get a detailed transaction history of mutual fund investment for the specific date inquired by you. You can also get a consolidated valuation report for a specific period.

Steps to follow to get CAS statement

STEP -1 Visit CAMS or Karvy Website and go to Investor SERVICE tab

STEP -2 Click on Consolidate account statement (CAMS+KFintech+FTAMAIL)

STEP -3 For detailed transaction-based report select “detailed” at the top (See illustration)

STEP -4 Select the period (see illustration)

STEP -5 Provide the EMAIL id, which was provided at the time of investment or in KYC.

STEP -6 Give your convenient password and SUBMIT.

After submitting the request, you will receive the details in your email.

The statement will contain all your mutual fund investment (across all mutual fund house) details from the date given by you.

There are other options also available for investors to explore. Like Capital gain statement, only valuation report, and so on.

The email which you will get is from “donotreplay@camsonline.com” and the sender name will be “CAMS MAILBACK SERVICE” The report is only the transaction history of your investment.

For tracking and monitoring of performance, we need to update these transactions on portfolio tracking websites.

Tracking Mutual fund performance

There are multiple options to track your mutual fund portfolio for free. I will discuss it with you most user-friendly platforms, in my opinion.

- Economics Times – ET Portfolio

- Money Control – Portfolio

- Value research – My investment

These are all multiple asset portfolio tracking platforms; here are the pros and cons of them.

ECONOMICS TIMES – ET Portfolio Tracker

Customers can log in or create a login either with their GOOGLE or FACEBOOK login.

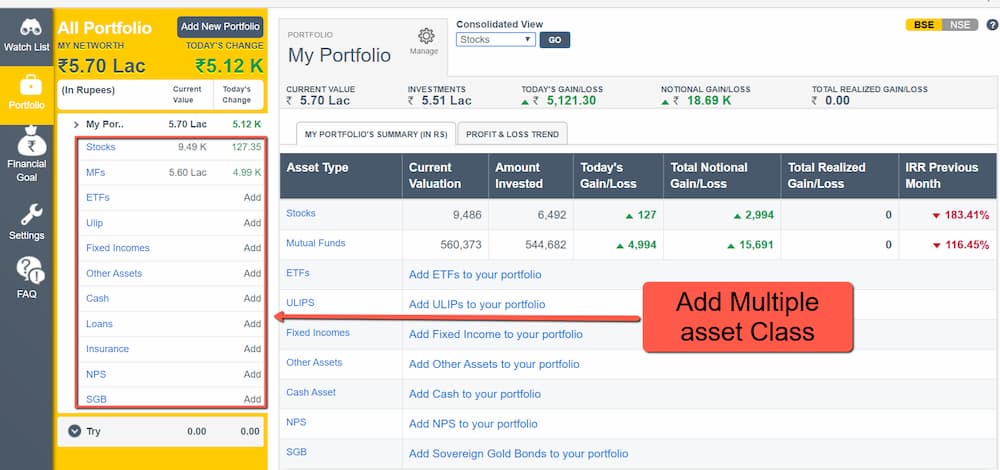

ET PORTFOLIO TRACKER is a multi-asset platform where you can track various asset classes. Like Stocks (shares), Mutual funds, Exchange Traded Funds (ETF), Fixed Income (like company NCDs), Loans, Sovereign Gold Bonds (SGB), National Pension Scheme, and Insurance.

You can monitor your asset and liability in one place.

You can enter your past transaction manually, or you can upload it in an excel sheet. The excel sheet format is on its website.

Investors through the website or Mobile app can monitor their portfolio on a real-time basis.

Money Control – Portfolio

Once a customer creates or logs in with existing credentials, the interface is smooth and comprehensive.

An investor can add and modify all their assets and liabilities and track accordingly.

Manually investors can update their old transactions on the website. Manual entry is one-time pain as future transactions related to SIP and company action is updated automatically.

Value Research – My Investment

Value research is one of the oldest and most respected mutual fund analysis and ranking company in INDIA.

I would recommend you track your investment through Value research as it is convenient and most comprehensive in analyzing mutual fund performance.

Besides mutual fund investment, you can also monitor your stock investment, Fixed deposits, NPS, and PPF.

The edge which value research portfolio tracker has is automated updating of the old transaction through a Consolidated Account Statement (CAS).

The investor has to get his/her CAS statement from KARVY or CAMS (as briefed above) and upload the same.

The software takes all future transactions for SIP installment, dividend, and Bonus updated automatically.

The portfolio report is very comprehensive, and the investor will get the reports on Market capitalization of your equity portfolio stocks, Ratings, and Type of your Debt Portfolio,Capital Gains, Taxation (payable feature), Annualized return and more.

Conclusion

Mutual Fund investors in INDIA traditionally served by distributors. Distributors serve the client about advising on the portfolio, future investment, and reporting on the existing investment.

Investors looking for details of their mutual fund investment can download their Consolidated Account Statement (CAS) from KARVY or CAMS website.

The tracking of mutual fund investment becomes accessible by the free portfolio tracker provided by leading companies like Moneycontrol.com, Economics Times, and Valuereasechonline.com.

These website not only provide insight on your portfolio but also give insights on other funds in the market.

You can track and monitor your mutual fund as well as other assets like Equity, Gold, Fixed Income in an easy manner. Do follow the step by step guide provided.

Do give your comments and feedback.

Great work….All related information at one place. Briefly put pros and cons for each platform. Thanks.

Like!! Thank you for publishing this awesome article.

Very good comments, i really love this site , i am happy to bookmarked and tell it to my friend, thanks for your sharing. Jerrie Trevor Filberte

I am regular reader, how are you everybody? This post posted at this web page is genuinely pleasant. Berny Cesare Gilcrest

I am not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for great information I was looking for this information for my mission. Eydie Clerc Volny

Greetings! Very helpful advice within this post! It is the little changes that produce the most significant changes. Thanks for sharing! Loria Erv Zobias

Hurrah! In the end I got a weblog from where I be capable of truly get useful facts regarding my study and

knowledge.