SIP through online banking is the easiest way to start your SIP Mutual fund investment. The process is paperless (online) and would take less than 10 minutes.

In case you are planning to start your SIP mutual fund investment, then you are in the right place.

SIP through Online banking helps customers to start SIP with various mutual fund companies. Like SBI, HDFC MUTUAL FUND, AXIS MUTUAL FUND, MIRAE MUTUAL FUND.

The systematic investment plan (SIP) is the Indian innovation to the world for the asset management industry. As of Feb 2020, there are more than 3.09 cr crore SIP accounts in INDIA, which mobilizes more than 8500 crores per month in different mutual fund schemes.

SIP helps retail investors to invest in a mutual fund scheme as SIP starts with as low as Rs 100 per month.

What is SIP or Systematic Investment Plan – How SIP Works?

SIP is a mode of investment, by which an investor can invest in a mutual fund scheme in a staggered manner, over a specified period.

The benefit to the investor is low average cost as investment happens over a period of time, investing in a disciplined manner due to automatic deduction for the chosen period, and avoiding timing of investment.

The maximum benefit of a systematic investment plan (SIP) an investor can get by taking right mutual fund rather than a best mutual fund. For more details do read

The traditional way to start SIP

The process and time required to register a Physical SIP form are cumbersome and time-consuming. As there are different intermediaries involved. The different stages involved are

- You or your broker – to fill the application

- Bank where you have a bank account – for registration of ECS mandate

- Mutual fund company – the collecting of application and coordination between bank and RTA

- Registrar and transfer agent (RTA)- like CAMS or KARVY – Data entry of the application and intimation to the bank, AMC, and investor for the transaction.

The physical application has to fill by you or your distributor (bank/ Individual advisers/National distributors, etc.) and submitted to Mutual company.

The company then sends the application to RTA. The RTA than processes the application on behalf of the mutual fund company. The RTA sends the ECS mandate to the bank, which is supposed to register the debit mandate if found in order.

Since in these processes, besides you, there are three intermediaries involved. The chances of error are high. Manual handling of applications at different stages leads to failure in processing.

SIP through online banking in 5 steps

The process is hassle-free, less time consuming, and paper-free method to start your SIP investment.

The method is called the BILLER REGISTRATION, and you will register your SIP in less than ten minutes. This process also cuts the long list of intermediaries and human error in processing physical application.

The process is error-free and gives total control to the investor to CHANGE, START or STOP investment at any time.

The biller process is registering of expense or investment payment authorization to your bank.

In this process, you give a standing instruction to the bank to pay on your behalf, whenever the registered biller company raises the bill. Like a Gas bill, electricity bill, insurance bill, etc.

The investor should be KYC (mutual fund) compliant, and customers should have internet banking/mobile banking access.

The Five steps to be followed

- Select the right scheme where you want to invest

- Visit the mutual fund company website and log in as an investor

- Choose SIP investment and the scheme/amount/date in which you want to invest

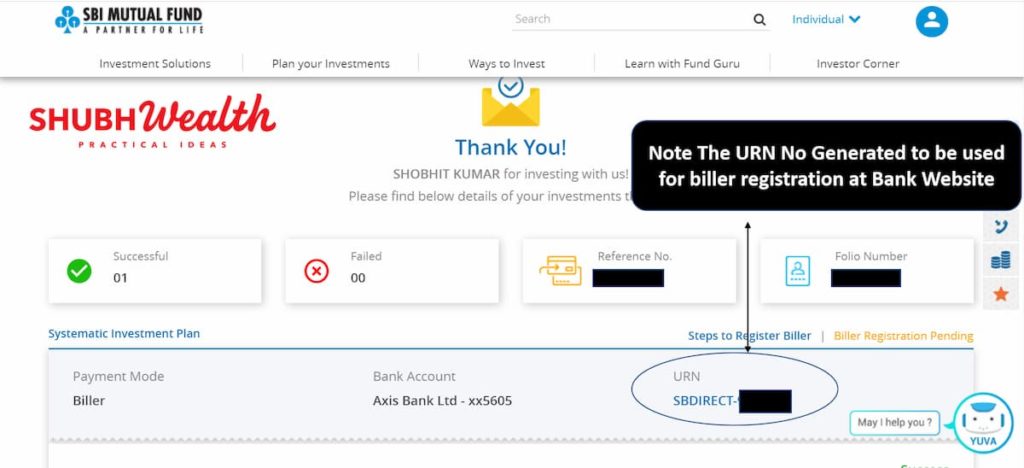

- Note UNIQUE REGISTRATION NUMBER (URN) and Transaction ID generated

- Visit your bank site or app and add as biller with URN and transaction ID

Your SIP registered.

In these simple five steps, you can start your SIP at any time. The chances of rejection are not there as it is an online process without any human intervention. The good news you can START-STOP, PAUSE, or CHANGE the SIPs at any time.

Registring with Mutual Fund companies

To help you understand the process, I have made step by step visual workflow to grasp and do the transaction hassle-free.

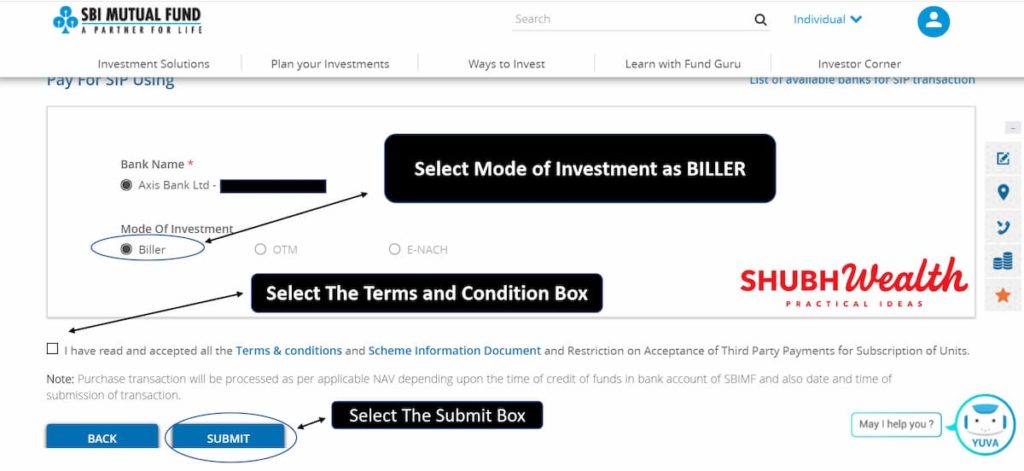

URN generation with SBI Mutual Fund

- Login or create your Mutual Fund account at mutual fund website

- Select New Investment or transaction

- Folio number and transaction type as SIP to be selected

- Fill the SIP details like scheme name, amount, debit date, etc

- Select payment mode as BILLER

6. Submit the details to Generate URN number

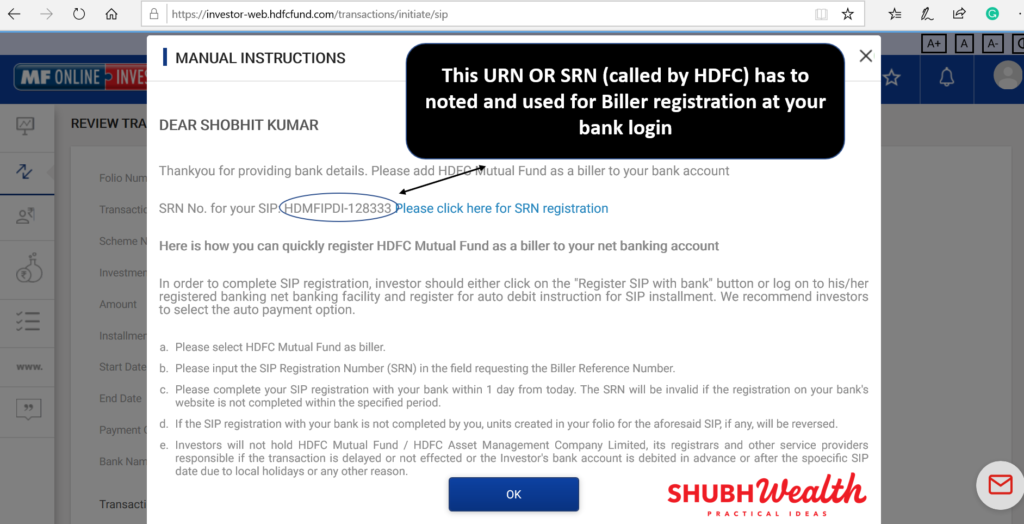

HDFC Mutual Fund – URN generation

- Login or create your Mutual Fund account at mutual fund website

- Select New Investment or transaction

- Folio number and transaction type as SIP to be selected

- Fill the SIP details like scheme name, amount, debit date, etc

- Select payment mode as BILLER

- Submit the details to Generate URN number

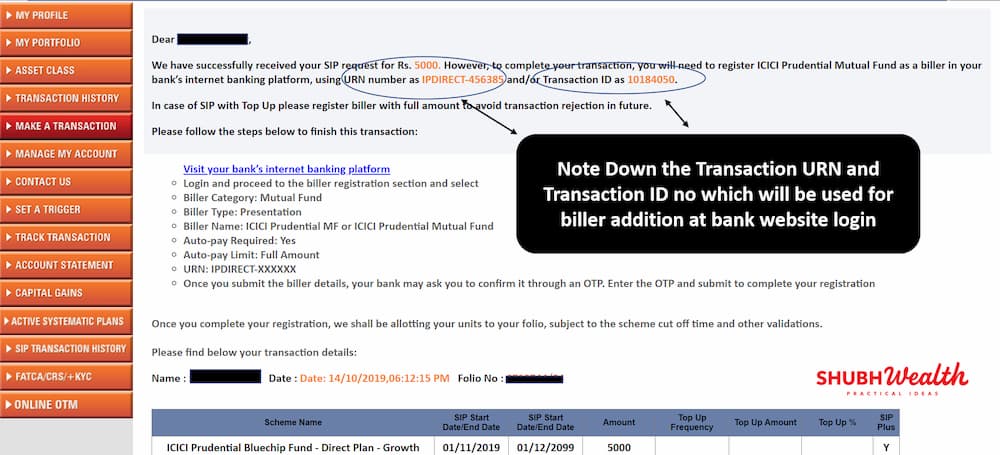

URN generation with ICICI PRU Mutual Fund

- Login or create your Mutual Fund account at mutual fund website

- Select New Investment or transaction

- Folio number and transaction type as SIP to be selected

- Fill the SIP details like scheme name, amount, debit date, etc

- Select payment mode as BILLER

- Submit the details to Generate URN number

There are minor variations in different company processes. As HDFC MF the URN is called SRN.

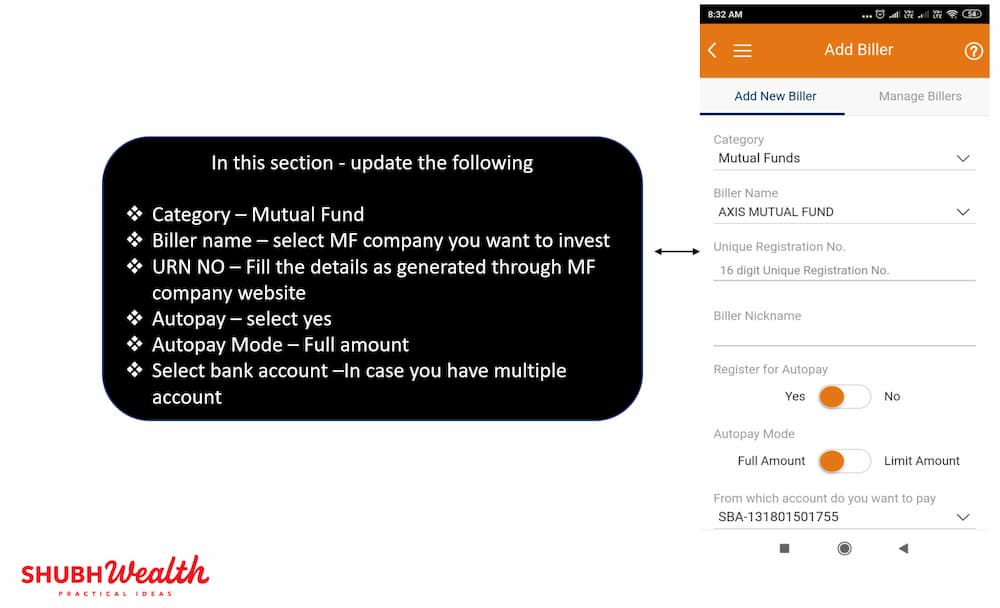

SIP registration through Online (net banking)Banking

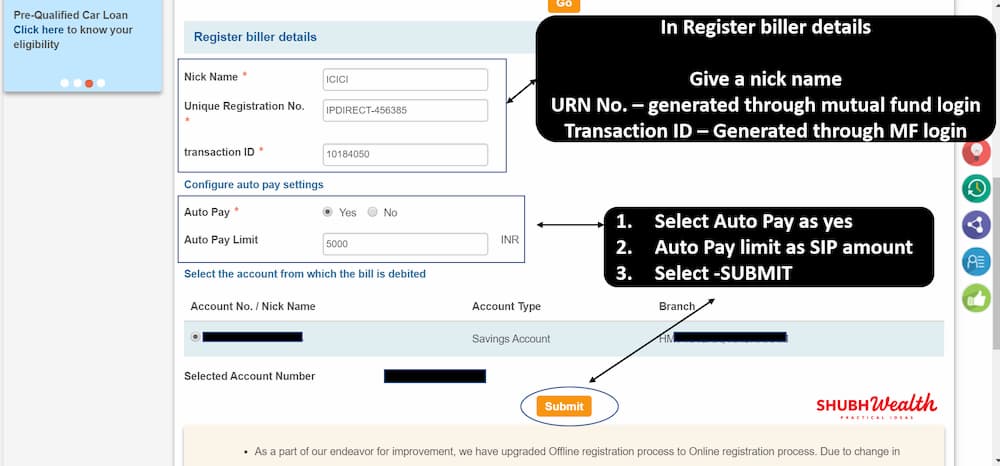

Once investors have generated UNIQUE REGISTRATION NUMBER (URN) through the mutual fund company website or mobile app, they have to visit their bank website or mobile app to register respective mutual fund companies as BILLER with URN generated.

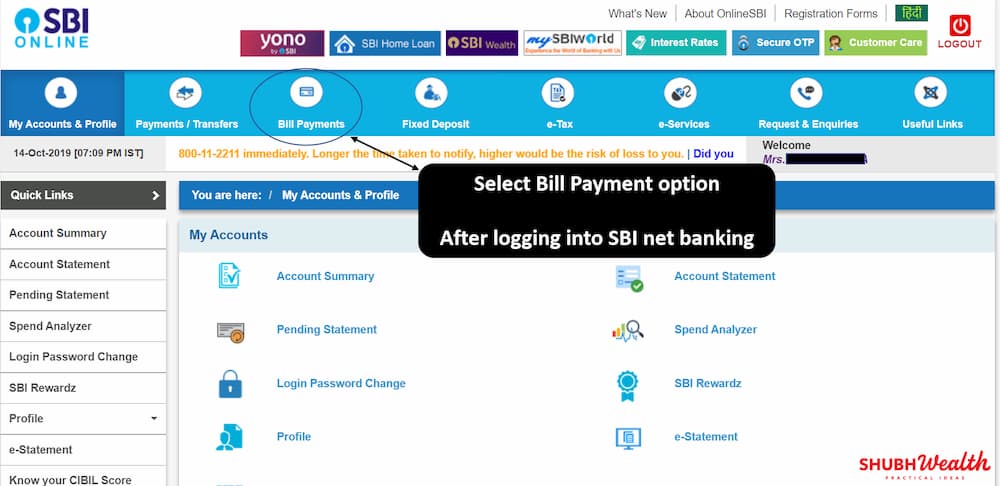

SBI online banking – SIP registration

The steps to follow to register your SIP with online banking

- Login to your SBI ONLINE banking account either though Desktop or Mobile

- Select BILL PAY option

3. In the bill pay menu, mutual fund option has to be selected

4. Select the mutual fund company for which you have generated URN number

5. Add details like URN NUMBER, Amount, transaction ID as taken from mutual fund website

6. Verify and submit the details- a confirmation message will come.

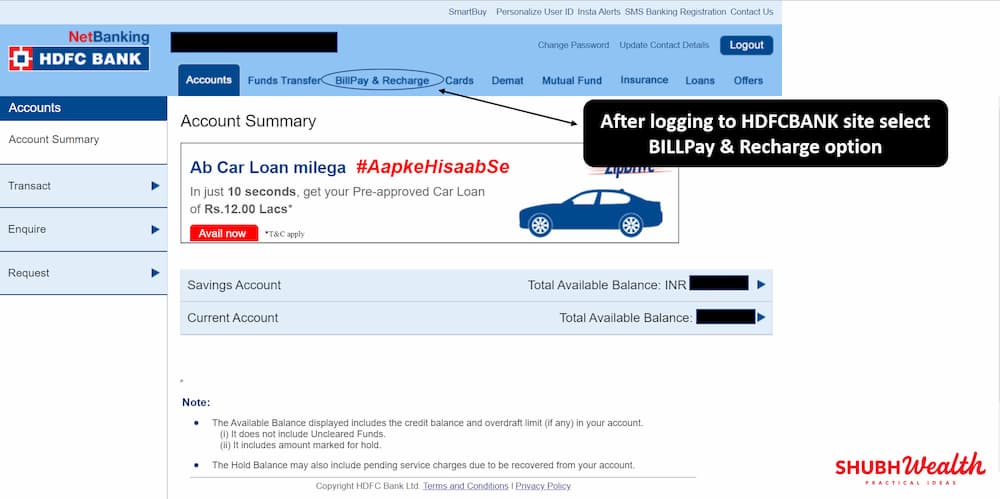

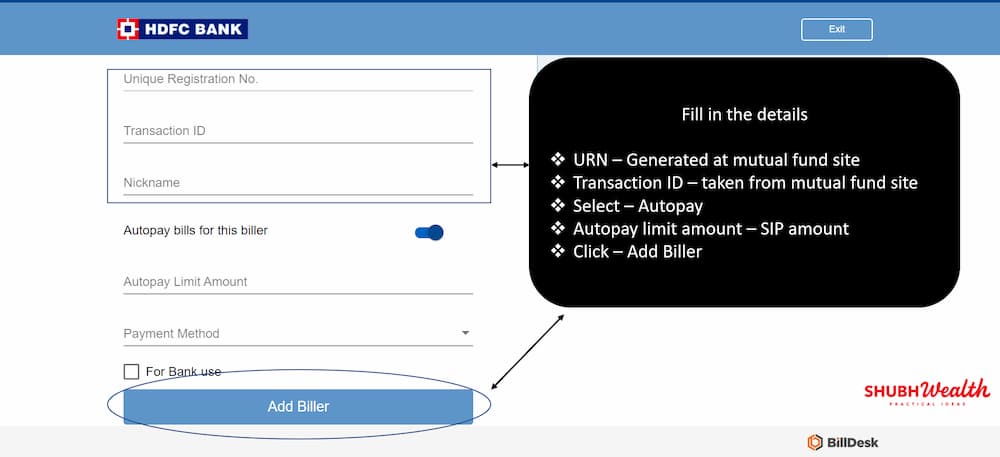

HDFC Netbanking – SIP registration

- Login to your HDFC net banking account either though Desktop or Mobile

2. Select BILL PAY option

3. In the bill pay menu, mutual fund option has to be selected

4. Select the mutual fund company in which you have generated URN number

5. Add details like URN NUMBER, Amount, transaction ID as taken from mutual fund website

6. Verify and submit the details- a confirmation message will come.

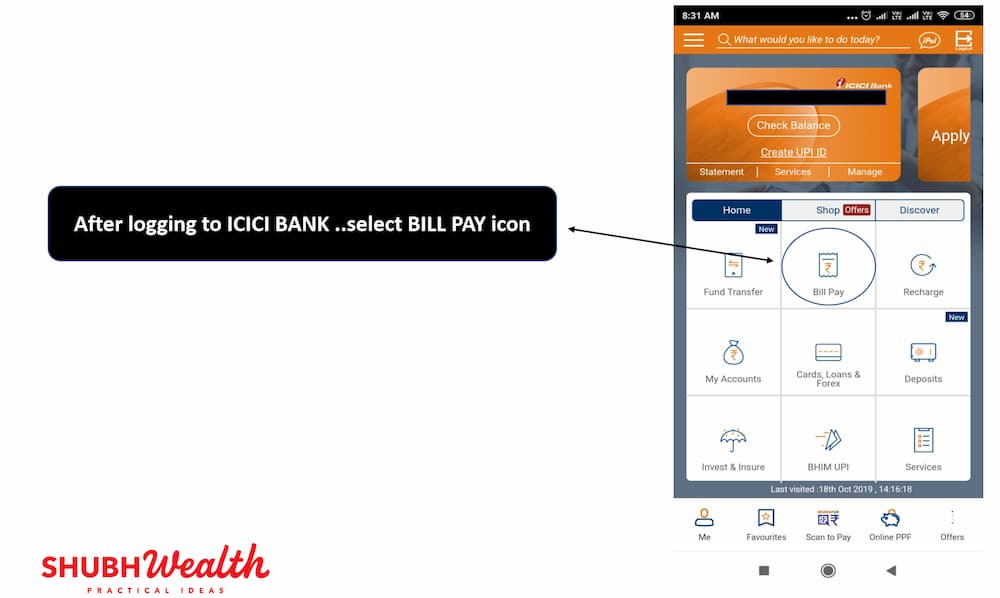

ICICI net banking – SIP registration

- Login to your ICICI net banking account either though Desktop or Mobile

2. Select BILL PAY option

3. In the bill pay menu, mutual fund option has to be selected

4. Select the mutual fund company for which you have generated URN number

5. Add details like URN NUMBER, Amount, transaction ID as taken from mutual fund website.

6. Verify and submit the details- a confirmation message will come.

The necessary procedure is the same for all banks. In SBI online banking, it is bill payment; ICICI net banking is Bill pay, whereas HDFC BANK net banking is Billpay and recharges.

Bottom Line

The growing popularity of mutual funds has led to an exponential increase in SIPs accounts and investors. An increasing number of applications has lead to a lot of operational issues as human involvement is required for data entry and processing of the transactions.

The best way to find a solution to manual error is to reduce human involvement, which can reduce transaction errors and processing time.

For NEW SIP registration, a biller mode is a good option. As there is no paperwork involved and instant registration and confirmation take place.

This process also reduces the time for intermediaries and investors.

The sip through online banking is only applicable to customers who have their KYC already processed and verified by KRA agencies. E-KYC has is not operational following the Supreme court order. The court has barred using AADHAR for personal verification.

Do let me know if you like the BILLER option for starting SIP investment. Shubhwealth.com.

Nice read. Gives in-depth very simple procedure to start investing sitting at home. Explores multiple options will logical comparison.

Thanks.

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.