“UNLOCKING THE ₹ 100 TRILLION OPPORTUNITY” is a vision report published by AMFI in consultation with BCG. The paper AMFI BCG report has analyzed past trends and future opportunities for all stakeholders related to the mutual fund industry.

My emphasis is to Highlights from the report the key take away, which can help the distributor community to understand the underlying trends in the industry and focus on new opportunities.

Facts about Indian Mutual Industry

- 17th largest asset management industry in the world based on AuM, having an asset of over INR 25 trillion.

- Indian innovation Systematic Investment Plan has doubled monthly contribution to Rs 8324 cr last 2 years

- 58% of industry AUM is now comprised of Individual investors and 45% industry AUM is Equity

- B15 (Beyond top 15 cities in terms of MF AUM) locations has now 25% contribution in mutual fund assets

- Financial savings are 60% of households’ total savings, and Mutual fund is only 6% of financial savings. (Exhibit 1.3)

- Approximately 7% of Indian family has mutual funds mainly from the metro, Tier 1 cities, and affluent households.

- The mutual fund has provided stability in the capital markets by becoming a key investor in the bond markets having 16% Share

- In Equity markets, Mutual funds’ share has increased from ~8.5% as of FY’14 to 18.4% as of FY’18

AMFI BCG Report takeaways

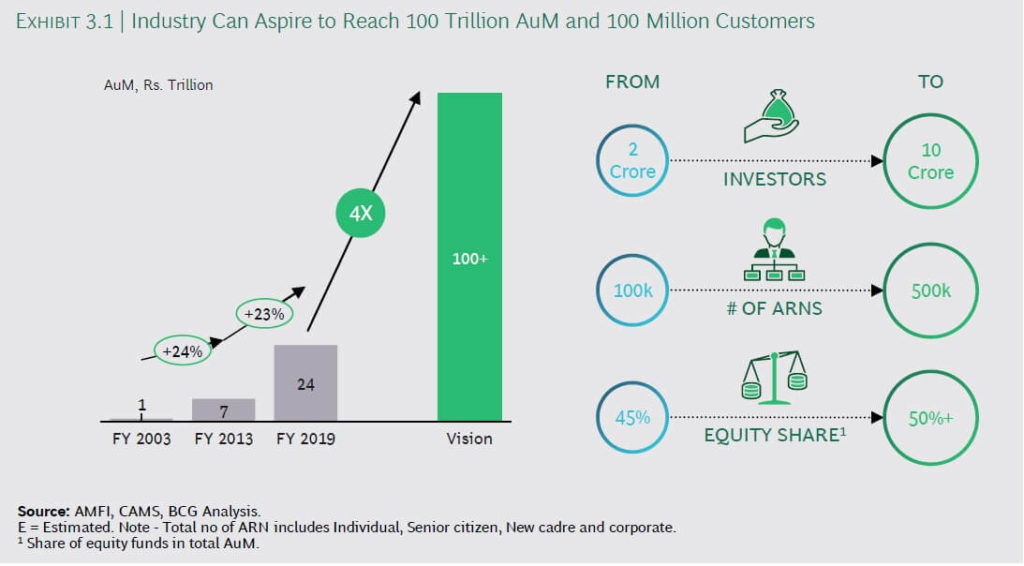

The BCG Vision Documents has given a pathway to attain Industry AUM of 100 trillion rupees by mid-twenties, ie, 2025 or so from current AUM of INR 25 trillion. (Exhibit 3.1)

To reach INR 100 trillion AUM goal the, industry required to add 8 crores more investors from the current 2 crores and to expand distribution outreach to 5 lakhs from current 1 lakh independent advisors. The key takes away from the report are as under…

The growth potential and opportunities in Non-metro locations is exponential

- The AuM in B15 cities grew at 34% CAGR between Mar’15 to Mar’18, which was much faster than 21% CAGR delivered by T15 towns during the same period.

- Approx. 70% for savings deposits come from B15 cities, whereas Mutual fund contribution is only 25% of total mutual fund contribution

- 90% of Indian Household is located in Tier 2 and beyond cities, mainly comprising of middle income (INR 3-10 lakhs) and the low-income household, which is untouched.

- The ARNs per million households in T15 cities are ~18 times higher than those in B15 cities

The emergence of New Investor category

- digital-savvy millennial – to constitute nearly 75% of the overall population and 70% of the working class by 2020, born in the 1980s, prefer transacting online

- the growing influence of women – Due to their financial independence and financially aware

- the rising elderly population– India will have ~350 million individuals over the age of 50 years by 2030

- Addressing the masses

- Until now, asset management players have primarily focused on households at the top end of the income pyramid (>INR 10 lakh household income), and located in metros and tier 1 cities

- The middle income (INR 3 lakh to 10 lakh) category is expected to constitute 46% of households by 2025 vis-à-vis 37% today. Besides, the lower-income (<INR 3 lakh) families are expected to represent 38% of households by 2025.

- A significant part of these investors will be from smaller towns—not only from B30 but also from B100 cities. Limited awareness about mutual funds amongst these new investors implies that a high touch engagement model will be required to guide, educate and assist these customers

- Deeper penetration into the savings wallet

- The share of Mutual funds in total financial saving is only 6%.

- Sustaining and increasing the share of mutual fund products in the overall savings wallet will be necessary to improve mutual fund penetration.

- Improved awareness about the benefits vis-à-vis other traditional investment products, as well as more sophisticated products like PMS and AIFs, will be required to drive this change.

Learnings for IFAs from AMFI BCG report

- Opportunities in Non-Metro locations (B30) will be exponential compared to metro locations.

The middle-income household (Income 3-10 lakhs) will be 46% of the total households, mainly in Non-Metro locations by 2025. The contribution of financial savings by Non-Metro families towards MF is minuscule compared to other financial savings. Savings products constitute 70% of the Financial savings in these locations.

Less competition due to less number of advisor per million and additional incentive by MF companies for business mobilized by B30 cities provide a great opportunity. These investors are required physical presence and hand-holding due to first time onboarding and less product knowledge. The mid, affluent and lower end of the HNI segment, which is available in Non-metro locations, is significantly under-served with sub-par advice and service. These are low hanging fruits that can be grabbed by IFAs.

- Targeting

a new set of investors

- The millennial will be a big opportunity as they will be 70% of the working population by 2020. They prefer to transact online, which means we need to be on an online platform to bring on board.

- Also, the population above 50 years will be in meaningful numbers in 5 -10 years from now.

- Females will be the next big opportunity due to their financial independence and joining the mainstream workforce.

- Cross-selling and Upselling

As the market grows and matures, generating additional return against there benchmark would be challenging owing to lesser opportunities. The recent regulatory changes by SEBI indicate the lowering of expenses. In this scenario, PASSIVE FUNDS like an Index fund, ETFs will be advantageous due to their low-cost structure.

As the expense of the existing schemes will come down, the brokerages will also come down. We need to look into other investment products like PMS and AIF for a better revenue generation portfolio mix.

Conclusion

To cater to the millennials, it is crucial to have a digital presence. Digital platforms are cost-effective, less time consuming and error-free. There are many low cost or free of cost online transaction platforms available to cater to these clients.

Senior investor, who are closer to their retirement age has to be catered through personal and periodic follow-ups. This can only be done through local talent available. Less volatile, regular cash flow, and tax efficiency are attributes which these kinds of investors expecting from there portfolio.

As the BHARAT, will evolve and grow, its middle-class household will create almost half of the INDIAN household population. We need to cater to these middle-class households, which are significant in numbers and relatively unexposed to Mutual fund investment.

The quantum of investment would be low, but the number of accounts will be enormous. Nonmetro cities contribute 70% of savings deposit, which shows there is massive potential in these markets, right product pitch and proper and regular communication will help in growing the business.

Targeting of masses will require the digitization of transactions to reduce time, error, and effort. This will help the efficiency of the distributor community and margin. Now it is more imperative that we follow a low-cost model as the margin will keep on shrinking in mutual fund products.

These insights may help you to chart effective long term strategy for growth… Shubhwealth.com

Use full knowledge

Everything is very open with a very clear description of the issues.

It was definitely informative. Your website is extremely helpful.

Thank you for sharing!

Thanks..appreciate your feedback

excellent post, very informative. I wonder why the opposite

specialists of this sector do not realize this. You must proceed your writing.

I am confident, you’ve a huge readers’ base already!

Thanks kiet…be in touch

I’ll immediately take hold of your rss as I can’t in finding your email subscription hyperlink or e-newsletter service.

Do you have any? Kindly let me recognize so that I could subscribe.

Thanks. Way cool! Some extremely valid points! I appreciate

you penning this write-up and the rest of the site is also really good.

Greetings from California! I’m bored to tears at work so I decided to browse

your site on my iphone during lunch break. I really like the information you present here and can’t wait to take a look when I get home.

I’m amazed at how fast your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyways, fantastic blog!

http://porsche.com

Thanks for appreciation..best of luck for the your effort

Now newsletter link is working..do subscribe

Very nice post. I juust stumbled upon your blog and wanted to

say that I’ve trully enjoyed surfing around your blog posts.

In any case I will be subscrikbing to your

feed and I hope you write again very soon!

I like it whenever people come together and share thoughts.Grest website,

contijue the good work!

Really innteresting information, I am suree this post has

touched all internet users, its really really pleasant piece

of writing on building up nnew website.

Hello There. I found you blog using google. This is an extremely well written article.

I’ll make sure to bookmark it and return to reawd more of your useful information. Thanks for the post.

I’ll certainly return.

This is the pdrfect bllog for anybody who hopes to find out about this

topic. You definitely pput a brand new spin on a topic which has

been discussed for decades.Wonderful stuff, just excellent!

Every weekend i used to pay a visit this site, because i want enjoyment,

as this this web page conations truly nice funny stuff too.

I need to to thank you for this fantastic read!! I definitely enjoyed every bit of it.I

have got you book-marked to look at new things you

post…

Your mode of describing all in this piece of writing is in fact pleasant, all be capable of

simply be aware of it, Thanks a lot.

Hello everyone, it’s my first visit at this website, and piece of writing is genuinely fruitful designed for me, keep

up posting such articles or reviews.

Wow cuz this is great work! Congrats and keep it up!

Very good post! We will be linking too this great content on our website.Keep up the great writing!

You actually make it seem really easy together with your presentation however I in finding this matter to be actually something that I feel I might

by no means understand. It sort of feels too complicated and extremely vast for me.

I’m looking ahead in your subsequent submit, I’ll attempt to get the grasp of it!

Here is my blog post … Poker Qq Online

Well composed articles like yours renews my faith in today’s writers.You’ve written information I can finally agree

onn and also use.Many thanks for sharing.

Would love to perpetually get updated outstanding web blog!

If you are going for most excellent contents like I do, just go to see this website all the time since it provides quality contents, thanks

Somebody essentially lend a hand to make significantly articles

I’d state. This is the very first time I frequented your web page

and thus far? I surprised with the analysis you made to create this actual submit extraordinary.

Great activity!

It’s going to be end of mine day, but before end I am reading this fantastic paragraph to improve my experience.

I am pleased that I detected this weeb blog, just the right informattion that I was searching

for!

I need to to thank you for this excellent read!! I certainly enjoyed every little

bit of it. I’ve got you saved as a favorite to look at

new things you post…

Like!! Great article post.Really thank you! Really Cool.

Looking forward to reading more. Great blog post.Much thanks again. Much obliged.

It’s truly a great and useful piece of information. I am happy that you just shared this helpful info with us.

Please stay us up to date like this. Thanks for sharing.

It’s really very complicated in this busy life to listen news on TV, thus I simply use the web for that reason, and get the hottest news.

I’m impressed, I have to admit. Rarely do I encounter a blog that’s equally educative and amusing, and let me tell you, you’ve hit the nail on the head. The problem is an issue that not enough folks are speaking intelligently about. I’m very happy I found this in my hunt for something concerning this.

Try to use a font size that is neither too big, taking over the page, or too small, making it extremely difficult to read.

Thank you for your article. Great.

Don’t hesitate to ask these players any questions you have so that you can learn from them.

These new skills, along with a lot of practice and dedication is what it takes to become a winning team.Increase Your Presence With These Blogging Tips!

When you are blogging, it is a good idea to start getting involved as an affiliate.

Learn to stretch the defense.

To be successful, make sure that your body stays between your opponent and the ball.

In addition, you should make an effort to respond to readers’ comments as often as possible.

Sure.Thanks.

To give you an edge when playing football, it is important to improve your endurance.

Aws Educate Machine Learning Pathway Non Literary Sources Of History

Also visit my blog … book epub (tslastockanalysis.blogspot.com)

Anything like this you can do to help you control the ball better is important.

Try expanding your skills beyond what you already possess.

This will assist it to also fight infections, and that includes acne.

Proper padding for the lower body is a must.

Don’t limit stretching to the few minutes prior to practice or games.

Remind yourself of this when you get discouraged – most people will need to practice for a total of several hundred hours at least before they achieve a high level of competency.

Thanks.

I simply want to say I am just very new to blogs and truly enjoyed you’re website. Most likely I’m want to bookmark your website . You really come with wonderful articles and reviews. Many thanks for sharing with us your web page.

Thanks a ton. you can also join my channel here.

https://www.youtube.com/channel/UCnELNPAjezGxNE-4QvPd9TQ

Thanks a ton. you can also join my channel here for more information on various articles.

https://www.youtube.com/channel/UCnELNPAjezGxNE-4QvPd9TQ

Thank a lot. Really appreciate it.

I’m truly enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Excellent work!

Thanks, it so cools