Sensex and NIFTY are standard terms in the area of the Stock market and investment. They are the benchmark of the stock market representing the broader market.

BSE SENSEX or S&P NIFTY 50 has become a famous name due to the financialization of assets in recent years in INDIA. As retail investor holding in stocks and Mutual funds has increased many folds.

SENSEX and NIFTY comprise of widely traded and most significant stocks in the stock market. The movement of these indexes indicates the financial health of companies and, in turn, the health of the economy. Due to this SENSEX and NIFTY are called the barometer of the stock markets.

What is INDEX like Sensex and NIFTY?

Stocks market has a listing of thousands of stocks, debt instruments like bonds and debentures, Gold, etc. At Bombay Stock Exchange (BSE), the number of shares listed is more than 5000, and the National Stock exchange (NSE) listed stocks are more than 1600.

SENSEX and NIFTY like benchmarks act as representatives of broader markets. Various sectors and market capitalizations of stocks listed at exchanges are represented by indices. They act as a ready reckoner for the respective industry or segment of stocks and their financial performance.

Stock exchanges have made various indexes to represent every segment or sector representing the stock market. Some of the Index created by Stock exchanges like BSE or NSE are

- S&P BSE SENSEX

- NIFTY 50

- S&P BSE Bharat 22 Index

- NIFTY BANK

- S&P BSE SmallCap

- S&P BSE 100

- NIFTY NEXT 50

- INDIA VIX

- S&P BSE MidCap

- NIFTY AUTO

- NIFTY REALTY

These indices help investors to understand the general trend in the economy and particular sector and market capitalization they represent.

Stocks in respective indices are selected on a free-float market capitalization basis. Free float market capitalization means the number of shares only available for trading publicly.

Know What is Sensex?

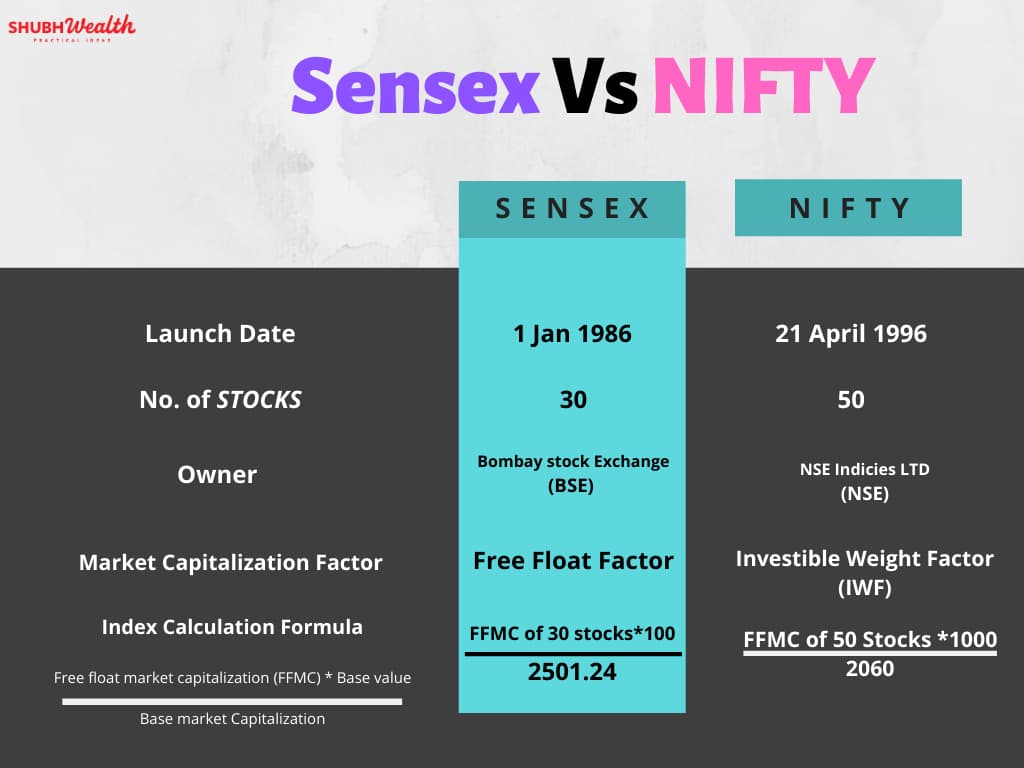

Sensex is a combination of two words Sensitive and Index. Officially operated by Bombay Stock Exchange (BSE) and on January 1, 1986, launched. The official name of SENSEX is S&P BSE Sensex.

SENSEX consists of 30 stocks selected from the listed universes of more than 5000 stocks at BSE. The idea of making SENSEX as the benchmark is to give yardstick of the performance of the stock market.

The value of SENSEX is calculated on the FREE float market capitalization basis of the 30 stocks which form part of the benchmark. The base financial year taken as 1978-79 and base value is taken as 100. The value of SENSEX is updated every 15 seconds.

The Sensex is one of the oldest stock indexes in India. Sensex, in the beginning, used the weighted market capitalization methodology, but from September 1, 2003, it shifted to the free Float Market Capitalization methodology for calculation of SENSEX value.

Selection criteria for 30 stocks for SENSEX benchmark

Bombay Stock exchange has segregated the stocks listed with them in various groups like A, B, T, and Z.

The PRECONDITIONS for shortlisting of stocks are as follows

- Z-Group companies excluded: These are companies that have not complied with BSE regulations.

- IPO’s: cannot be included in Sensex. Companies must be listed in BSE for a minimum of 3 months.

- Daily Trading: In its past 3-month cycle, the company’s stock must have been traded every day.

- Reporting: The company must have submitted their quarterly reports for the last four quarters.

Those stocks which qualify preconditions to go for SCREENING on the below-mentioned basis

- (Free-Float): The shortlisted companies are listed in order of their “average three-month float market capitalization.” Only the top 75 ranked companies are considered for further screening.

- (Full Market Cap): All 5,000+ companies are ranked based on their full market capitalization (3 months average). Again, the top 75 ranked companies are selected.

The combined list of 150 (75+75) companies is selected.

- (Trading Volume): The list of combined companies is then ranked once again based on their average traded volume (of the last three months). Companies whose cumulated value traded is <98% are excluded from the list.

- (Weigh): Balance companies are again ranked based on float-market capitalization. Companies that had a calculated weight of less than 0.5% are excluded.

- The balance that remains (Top 30) – gives the final list of the Sensex 30 companies.

How Sensex is calculated?

The formula used for calculation of SENSEX value is

Method of Sensex calculation= (Sum of 30 stocks free-float market capitalization/ Base market capitalization) * Base index value.

The base year to calculate Sensex is 1978-79 and according to BSE base market capitalization is taken as Rs. 2501.24.

The base index value is 100.

Therefore

Sensex= free-float market capitalization of 30 selected companies /2501.24 crores* 100

Free-Float Market Capitalization = Market Capitalization * Free Float Factor

Free Float factor: Free float shares are portion or percentage of shares issued by the company, which is easily available for trade in the market. These shares are not part of shares held by promoters or government. Therefore, the free float factor is determined by dividing free float shares by the total number of shares listed by the company.

All about NIFTY

The National Stock Exchange (NSE) launched its benchmark Index, the NIFTY, with 50 stocks from leading companies on April 21, 1996. The benchmark index is used for purposes like benchmarking fund portfolios, index-based derivatives, and index funds.

The name Nifty which is derived from National and Fifty is an equity benchmark index for the Indian Equity Market.

NSE Indices Limited owns and manages the NIFTY index. (formerly known as India Index Services & Products Limited).

The NIFTY 50 Index represents the broad-based market as it represents about 66.8% of the free-float market capitalization of the stocks listed on NSE as on March 29, 2019. The total traded value of NIFTY 50 index constituents for the last six months ending March 2019 is approximately 53.4% of the traded value of all stocks on the NSE.

Calculation of NIFTY value

The free-float market capitalization-weighted method is used to compute NIFTY, wherein the level of the Index reflects the total market value of all the stocks in the Index relative to the base period November 3, 1995.

The total market cap of a company or the market capitalization is the product of market price and the total number of outstanding shares of the company.

Index Value = Free Float Market Capitalization / Base Market Capital * Base Index Value (1000)

Where

Free Float Market Capitalization = Shares outstanding * Price * IWF

Base market capital is of Rs 2.06 trillion, which is value as on November 3, 1995. It is the aggregate market capitalization of each scrip in the Index during the base period.

Base Index Value during the base period is equated to an Index value of 1000.

Investible Weight Factors (IWF) is a factor that determines the shares available for freely trading in the market.

The IWF’s for each company in the Index are determined based on the public shareholding of the companies and does not include shares held by people having strategic interest in a company.

The following categories are excluded from the Investible Weight Factors (IWF) computation:

- Shareholding of promoter and promoter group

- Government holding in the capacity of the strategic investor

- Shares held by promoters through ADR/GDRs.

- Strategic stakes by corporate bodies

- Investments under FDI category

- Equity held by associate/group companies (cross-holdings)

- Employee Welfare Trusts

- Shares under lock-in category

Screening Criteria for selection of NIFTY 50 stocks

There are more than 1600 stocks listed on the NSE browser. There are four screening criteria to become part of the NIFTY 50 companies. They are

- Liquidity: For inclusion in the Index, the security should have traded at an average impact cost of 0.50 % or less during the last six months for 90% of the observations for a portfolio of Rs. 10 crores.

- Impact cost is the cost of executing a transaction in a security in proportion to its index weight, measured by market capitalization at any point in time. This is the percentage mark-up suffered while buying/selling the desired quantity of a security compared to its ideal price — (best buy + best sell)/2.

- Float-Adjusted Market Capitalization: Companies will be eligible for inclusion in the NIFTY 50 index provided the average free-float market capitalization is at least 1.5 times the average free-float market capitalization of the smallest constituent in the Index.

- Listing History: A company that comes out with an IPO is eligible for inclusion in the Index if it fulfills the standard eligibility criteria for the Index – impact cost, float-adjusted market capitalization for three months instead of six months.

- Trading Frequency: The company’s trading frequency should be 100% in the last six months.

Those stocks which successfully met the above-mentioned conditions are arranged according to their free-float market capitalization, and the top 50 shares form part of the NIFTY Index.

INDEX INVESTING (Sensex and NIFTY)

Indexes like NIFTY or SENSEX represent the stock market in the broadest way possible. The stocks which form part of indexes are high on market valuation, readily available for trade, have a good track record in terms of business performance and regulatory compliances.

Most of the advanced countries where the stock market is mature, INDEX investing is famous and has a significant market share in the investor portfolios.

Index funds and Exchange Traded Funds (ETFs) are popular ways to invest in INDEXs. The most popular INDEX funds or ETFs are based upon NIFTY or SENSEX.

Index funds

These are the passive funds floated by mutual fund companies. These funds are known as passive funds as they follow the same stocks and weights for investment as the underlying benchmark. Therefore, they mimic the performance of the Index they follow like NIFTY or SENSEX

The objective of the INDEX FUNDS is to mirror the performance of the underlying INDEX at the minimum cost.

Passive funds have slowly gained popularity as, in the long run, active funds have shown similar returns as their benchmark. So, passive funds have an advantage due to their low-cost structure and less human interventions.

As the market matures, the probability of passive funds outperforming active funds will be more due to their low expenses and more competition among market participants.

The performance of INDEX funds is measured by TREKKING ERROR. The tracking error measures the deviation of fund return from the benchmark. The lower the tracking error, the better the fund’s performance.

Examples of INDEX FUNDS are Birla Sun Life Index Fund, Franklin India Index Fund – NSE Nifty Plan, HDFC Index Fund – Nifty Plan, ICICI Prudential Nifty Index Fund.

Various index funds performance can be seen through moneycontrol website.

INDEX funds can be bought through respective mutual fund companies through your advisor or directly from companies’ offices or websites. The Systematic investment plan (SIP) route can also be taken to have exposer in INDEX FUNDS.

EXCHANGE TRADED FUNDS

An ETF or Exchange Traded Fund also tracks an index. They can be bought or sold just like shares at the stock exchanges at Bombay Stock Exchange (BSE) or National Stock Exchange (NSE).

There are various ETF based upon INDEX floated by exchanges like NIFTY, SENSEX, G-SEC or PSU Bank

As ETFs are listed on stock exchanges, they have to be bought and sold through a stockbroker. They will be held in the DEMAT account only. The variety of ETFs is more than INDEX FUNDS.

ETFs are more cost-efficient than INDEXED FUNDS. The transaction in ETFs is smooth compared to INDEX FUNDS, as investors need not open a separate account to hold ETFs or transact on them. ETFs can be bought and sold in their existing DEMAT account.

Few examples: Birla Sun Life Nifty ETF, Edelweiss ETS – Banking, Kotak PSU Bank ETF, MOSt Shares M100 or SBI ETF 10-year Gilt

Conclusion

index plays a pivotal role in understanding the sentiment and fundamentals of a particular sector or economy as a whole. Growing Index represents a positive outlook for a specific industry and economy at large. Indexes are also very helpful for new investors who are not familiar with financial markets.

NIFTY and SENSEX are leading indices in INDIA, which represents more than 60% of the market capitalization of stock exchanges. NIFTY symbolizes 50, and SENSEX constitutes 30 most liquid and biggest market capitalization stocks.

They represent the mood and fundamentals of the market, and it is a sense of pride for companies to be part of these indices.

As the market is maturing and the number of market participants is increasing, New investment avenues are opening up. INDEX FUNDs and INDEX Exchange-traded funds (ETF) are slowly gaining pace. The biggest positive for these investment instruments are ease of transaction and low cost.

Icebreaking information for , new investor like me. keep writing basic informations

Very good page, Carry on the great work. thnx!

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Pingback: Basics to know before investing in the Stock Market