Be Part of an INDUSTRY that has doubled in the last five years.

In 2020, The size of the INDUSTRY is Rs. 22.26 lakh crore and still only 6% of financial savings.

More than Rs 7948 crore commission distributed to 1073 distributors/advisors in FY 2018-19 (Source -AMFI).

With only Rs. 5000/- you can start your Mutual Fund Distribution business.

Join an INDUSTRY that has beaten the Stock market (benchmark) return consistently over a longer period.

Get commission till the investment lasts every month (TRAIL commission).

The Mutual Fund Industry

I know the above headline must have ringed a bell in your ear. That is only a beginning.

Let me share some facts with you…

The MF Industry’s AUM has grown from ₹ 10.83 lakh crore as on March 31, 2015, to ₹22.26 lakh crore as on March 31, 2020, more than 2-fold increase in 5 years.

The ten-year compounding growth for mutual fund Assets Under Management (AUM) from the financial year 2009 to the fiscal year 2019 was approximately 19%.

Average assets of Mutual Funds in India has registered a compound annual growth rate (CAGR) of 25 percent over the five years (2013-2018). The growth has outstripped the CAGR of only 11 percent registered by aggregate bank deposits of scheduled commercial banks (SCBs).

The reason for such extraordinary growth has been multiple.

Benefits such as diversification, access to equity, and debt markets at low transaction costs and liquidity are some such advantages.

Multiple benefits have led to mass participation by the retail and institutional investors in mutual funds. The total number of accounts (or folios as per mutual fund parlance) as on March 31, 2020, stood at 8.97 crores. Investor numbers are growing for 70 consecutive months, witnessing a rise in the no. of folios in the mutual fund industry.

As investment in capital market instruments involves risks, and individual investors lack expertise concerning portfolio construction, stock selection, and market timing here Mutual Funds step in to pool money from a broad cross-section of investors and diversify risk by investing in a portfolio of stocks, bonds, and money market instruments.

Mutual Fund advisor can play a pivotal role in educating and benefits of mutual funds to the investor.

Business Potential

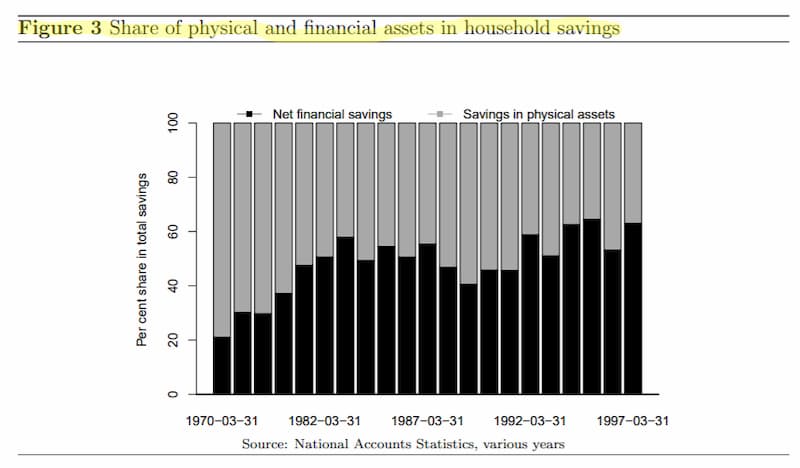

There is a gradual financialization of savings in INDIA. The Government’s measures to curb black money through demonetization has helped increase the share of financial savings.

There is also a gradual reduction in investment in physical gold and Real Estate, and that money is moving in Financial assets.

An increase in financial literacy and higher mutual fund returns is likely to push up the share of mutual funds within financial savings. In turn, benefiting the related business holders like mutual fund advisors.

Those mutual fund advisors with good network and robust technological platform will stand to gain.

Mutual fund penetration in India is much lower than the world average and many other economies.

While the US has its AUM more than the country’s GDP at 103 percent, it is only 11 percent in India. The world average is 55 percent.

Mutual fund penetration in other countries presents considerable scope for the mutual fund industry to grow. The quantum of money with a 1% increase in mutual fund share would be in lakhs of crore.

Mutual Funds are only 6% of Financial assets saved by INDIANS.

In India, though financial savings are increasing, the money is going to the traditional investments like Bank Fixed Deposits or POST OFFICE schemes.

The Share of Mutual fund has double in the overall kitty of financial assets, but still, it is tiny.

Become a Nextgen Mutual fund advisor. Join workshop that will prepare for the MF certification exam (NISM VA) and help you set up a profitable business.

First 50 registration FREE !!! (ENROLL NOW)

What is there for Mutual Fund Distributor?

This mutual fund business presents a massive opportunity for everyone, and anyone who wants to diversify income and make a difference in others’ life.

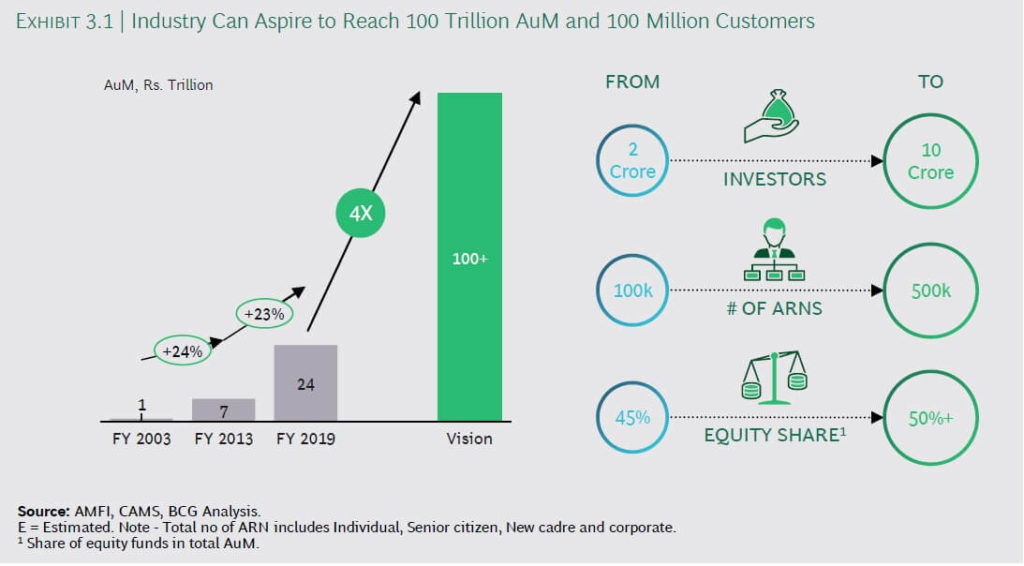

As per the AMFI BCG report, there would be a requirement of more than five lakhs mutual fund advisors in the coming years. At present, in INDIA, there are only 1.5 lakh advisors to reach the industry size of 100 lakh crore.

Mutual fund industry AUM projected to grow at 17% to 19%; according to CRISIL, the mutual fund industry’s AUM projected to grow from ₹23.8 trillion as of March 31, 2019, to ₹54 trillion by the financial year 2024

Why Should you become a mutual fund advisor?

- TRAIL Commission

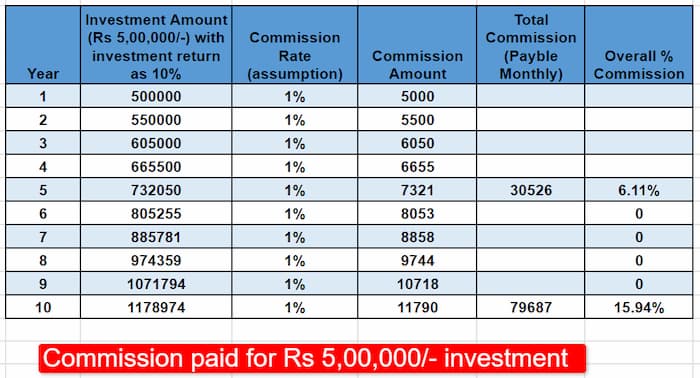

Distributors of mutual funds are given a commission in trail form. Trail means that the distributor gets a commission on the business until the lifetime of the investment.

For example: Suppose you advised your investor to invest Rs 5,00,000/ – lakhs in a mutual fund for ten years. In this case, you will be getting the commission for all ten years for this one-time effort.

So your one-time effort will be compensated by the mutual fund company till the investment lasts. The icing on the cake is the commission will be on the present value and not on the investment value. See illustration

There are different commission rates for various mutual fund schemes and vary from time to time. Also, there is an additional commission for business mobilized from smaller towns and cities (Beyond 30 cities).

From the above illustration, you can see that the longer money invested, the more revenue advisor receives without any additional cost or effort. Mutual Fund advisor can comfort from this fact.

- Negligible capital investment

Mutual fund distribution business can be started with a negligible initial investment; there is hardly any capital required.

The only expense is on your NISM VA exam (Rs 1500) and costs for AMFI Registration Number (ARN) application (Rs 3000).

The mutual fund companies themselves provide other infrastructures like application, processing, and business details.

There is software support provided by AMFI for free (MFU) for online transaction processing.

- Low investment amount to start mutual fund investment

The mutual fund investment can start from as low as Rs 100 per month. Therefore it is elementary to get on board with mutual fund products.

Conclusion

I have tried to give you an overview of the mutual fund industry, its future outlook, and its business potential.

The future of the mutual fund business looks very good in INDIA. The primary reason is the product.

The cost of the product is low; past performance is better than most of the traditional products like BANK Fixed deposit, POST OFFICE schemes, INSURANCE Products along with liquidity and taxation.

Interest rates in traditional saving products in the market like BANK Fixed Deposit and Post office schemes are coming down. These investors are looking for reliable and cost-efficient investment vehicles to meet their financial goals.

There is massive scope for investment vehicles like MUTUAL FUNDS, which tick all the right boxes.

Reference

- https://www.amfiindia.com/Themes/Theme1/downloads/BCG-Banner7.pdf

- https://www.financialexpress.com/market/india-just-waking-up-to-mutual-fund-investments-us-has-more-than-gdp-in-aum-india-lags-at-this-much/1824082/

- http://www.investmentbank.kotak.com/downloads/computer-age-management-services-limited-DRHP.pdf

- https://www.amfiindia.com/commission-disclosure

- https://www.amfiindia.com/research-information

Why people still make use of to read news papers when in this technological world everything is available on web?

Like!! Thank you for publishing this awesome article.

Whats up are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you need any coding expertise to make your own blog? Any help would be greatly appreciated!

Howdy! This post couldn’t be written any better! Reading this post reminds me of my good old room mate! He always kept talking about this. I will forward this write-up to him. Fairly certain he will have a good read. Thank you for sharing!

I have to thank you for the efforts you have put in penning this blog. I really hope to view the same high-grade blog posts from you later on as well. In fact, your creative writing abilities has encouraged me to get my own, personal blog now ;)|

I simply want to say I am newbie to blogs and certainly enjoyed this web blog. Almost certainly I’m going to bookmark your blog . You definitely have beneficial articles. With thanks for revealing your website.

Pingback: Guide to Mutual Fund Distributors Exam – NISM VA | Free !! Mock test

Little Prince Volcano Continuing Education Courses Physical Therapy

my blog; bog (ps4backbuttonattachment.blogspot.com)

Hey, I couldn’t find your email and hence I am contacting you via blog comments. Just wanted to send you some gov and .edu backlinks (100 free) for SEO. It’s a small list of around 100 .edu and .gov backlinks that can provide your website with some good authority. Check it out: https://justpaste.it/free-gov-edu-backlinks

Thanks a ton. you can also join my channel here for more information on various articles.

https://www.youtube.com/channel/UCnELNPAjezGxNE-4QvPd9TQ