Largecap, Midcap and Smallcap are common terminologies used while you are reading or inquiring about the stock market or Mutual fund investment.

Here, The purpose is to explain some of these common terms which you may encounter while discussing with your friends, adviser or searching through the internet.

The success of Mutual funds can be contributed to various factors like better return compared to other asset classes, transparency, low-cost structure, proactive regulatory environment by SEBI, investment mode like SIPs etc.

SEBI Regulation

Rationalization and classification of various mutual fund schemes have been one of the many steps which the mutual fund regulator SEBI has taken to make the products standard and easy to comprehend by investors.

In this direction, SEBI has issued a circular dated 6th October 2017 via circular no SEBI/HO/IMD/DF3/CIR/P/2017/114. Mutual fund scheme and stock classification criteria updated in this circular.

Classification of the Mutual fund schemes

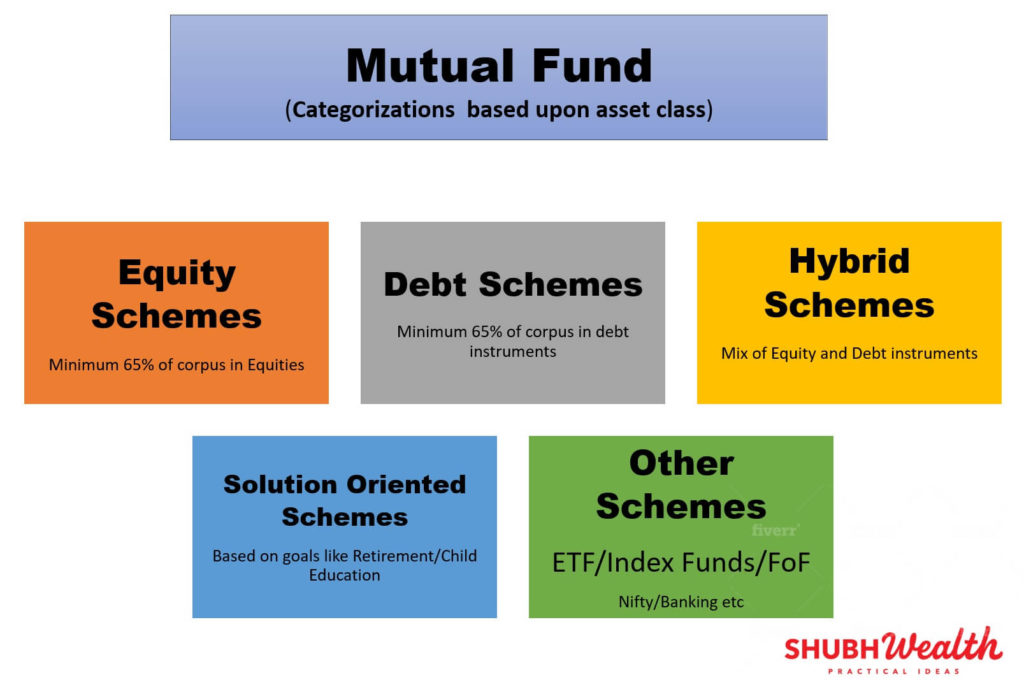

The Mutual Fund Schemes would be broadly classified in the following categories :

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution-Oriented Schemes

- Other Schemes

Equity schemes are those, which invest predominantly in stocks/shares of the listed companies. According to SEBI regulation, the average equity exposer has to be 65% of the AUM/Corpus of the fund during a financial year to be qualified as Equity scheme.

There are various types of Equity schemes depending on the kind of stocks it has in its portfolio. Like largecap, Midcap, smallcap, Dividend yield, Pharma, Infra, banking, etc.

Debt Schemes will invest in debt securities with an average investment of 65% of the corpus in a Financial year in debt securities. There are various kinds of Debt schemes classified mainly on the basis of maturity profile (from 1 day to more than 7 years) and risk profile (Credit Risk) of the securities under the scheme/Fund.

Hybrid funds as the name suggest have a mix of both Equity and debt securities. Equity investment can vary from 0 to 100 % and the same with Debt securities.

According to the scheme objective, a particular scheme will have a debt-equity mix, Like a conservative Hybrid Fund can have equity expose between 10 -25 percent and rest debt. Dynamic asset allocation or Balanced advantage fund can have 0-100 percent between Equity and Debt etc

Schemes that are targeted for particular purpose retirement or child education are called Solution-oriented schemes. Retirement corpus or Children education requirements. These schemes will have 5 years lock-in period or target age for retirement or child majority age.

Other mutual fund Schemes are defined as Index funds, Exchange-traded funds or Funds of Funds (invest in another mutual fund scheme). They are low-cost products, which are passive in nature. They replicate existing portfolios.

LargeCap, MidCap, and SmallCap stocks

Below mentioned are the definition Large-cap,Mid-cap, and Small-cap stocks. This is to make uniformity of the stock universe for equity mutual fund schemes for all mutual fund houses.

LargeCap: 1st -100th company in terms of full market capitalization listed in a browser like NSE or BSE

Mid Cap: 101st -250th company in terms of full market capitalization listed in a browser like NSE or BSE

Small-Cap: 251st company onwards in terms of full market capitalization listed in a browser like NSE or BSE

These new classifications, data is arranged through the Stock exchanges. ie NSE and BSE. Market capitalization means the total market value of a particular company. The value can be computed by multiplying the current stock price with the total outstanding shares of the company.

The data is published by AMFI every Half-yearly and available through their website. The portfolio of respective funds has to realigned as per new data and as per their mandate. Like large-cap, Midcap, small-cap, Multicap, etc

CONCLUSION

To sum up, The Top 100 stocks as per there market value is termed as LARGECAP. As the name suggests, they are the biggest companies in the market in terms of market capitalization.

large-cap funds which constitute of these stocks will be least volatile among all the schemes in the equity category.

MIDCAP funds will be having stocks that are from 101 to 250 in terms of market capitalization. As these are relatively smaller than large caps, they are more volatile and have the potential of higher growth, therefore, they can generate additional returns compared to large caps over a long period of time.

All the stocks after 250 in terms of market capitalization are classified as Small-cap stocks. They are having the largest universe of more than 4700 stocks (as per June 2019 data).

As these companies are smallest of all in terms of business size and their business risk is highest leading to a higher risk of investment compared to the other two categories.

To mitigate the risk of investment, we need to have a varied time horizon according to the risk profile of the fund we are investing in. For example, a Small-cap fund should be invested for a period of 7-10 years to mitigate the interim volatility. Midcap Fund should be invested for 5-7 years and larger cap funds should be invested for a 3-5 year time period.

I have tried to give you, basics ideas of repetitive terms used while investing in mutual funds. Love to hear feedback and suggestion from you. Shubhwealth.com

Nice article. Very succinct and easy to understand. Curious to know about what factors (top 5) to consider to choose among the investment schemes mentioned especially among equity, debt and hybrid schemes.

Excellent. Well explained in very simple language for a common man to understand…

Thanks Sir,nice to hear from you.

Important information about time horizon to be invested in different type of mutual fund categories. Thank you. Looking forward for more post like this.

Informative article, with help of it one could minimize the risk while investing hard earned money.

Got the basic idea of mutual funds. Thanks for the information. Looking forward for more posts about equity

Thanks for appreciation, we will keep on posting relevant ideas for investment

Very neatly explained about M.F. keep it up sir..

Nicely explained in simple terms.. looking forward for many more posts

Thanks anannya…be in touch

Thank you, it’s very useful for a layman like me. Thanks again. Keep it up.

Thanks Nitin,keep in touch

Very informative post, keep the good work

Very informative , easy to understand ….

Wow !

Way to go!

Helps a lot. Looking forward for more such informative blogs.

All the best.

Finance at Finger tips .Nie attemt

Thanks Goutam..

Basic terminology explained in layman terms. Great work.

Pingback: Mutual Fund details everyone Should know before investing • ShubhWealth

Pingback: 3 best ways to increase your SIP returns • ShubhWealth

Pingback: How to reduce capital gain tax through Indexation? • ShubhWealth

Pingback: Sensex and NIFTY | Meaning and differences • ShubhWealth

Pingback: Choose Best mutual fund or Right mutual fund | Criteria and tips

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Simple explanaton easy for everyone to understand. Thx

Pingback: Basics to know before investing in the Stock Market